Most common user errors crypto newbies make

Cryptocurrencies give the user more control and remove a lot of third-party reliance and support on various issues. Removing third-party reliance means users have to take full responsibility to protect themselves from fraud -- especially the common phishing attempts.

In most cases, insecurity manifests as or arises from mistakes made by users or their failure to take responsibility where and when they should.

Here are top mistakes made by newbies in crypto dealings.

1. Leaving funds on an exchange and not holding your private key

Over the years, hundreds of millions of dollars have been lost because people trusted one or two crypto exchanges that were later compromised or a wallet service that later crashed. Loosing your private key means your coins are completely lost so always create a backup of the key.

Never see an exchange service as a wallet service unless it says so. Exchange services only facilitate the selling and buying of cryptocurrencies. Otherwise, the exchanges are likely to exert control over the funds.

Also, ensure to enable and back up your two-factor authentication restoration code somewhere offline because most of them do not have the support that you can call for restoration.

Read more on the top ten exchange markets where you can buy or sell cryptocurrencies.

2. Being unaware of or inability to identify phishing and phishing attackers

For instance, phishing attempts, which mainly prey on fear and greed, is where an attacker impersonates reputable sources to lure victims to give money, or give access or data the attacker should not have. It is common on Slack and other cryptocurrency platforms and messaging services.

To deal with this, never trust links sent via alerts and emails or other messages whether they are for sites like MyEtherWallet, Coinbase, Kraken, or any other blockchain sites. When you search for a crypto site or click on a link, ensure that all the certificate are OK.

Top of the browser at the URL address bar on your left hand, there should be a green lock to show that the site is secure. Otherwise, it is not.

You can also use hardware wallets for extra security because they will protect your crypto even when the computer has malware.

If unsure, check on social media and internet to see whether what you are about to deal with is a scam -- most scams will be widely reported within a few days of operation.

Also, with so many scams and Ponzi cryptocurrency schemes floating around, it is only advisable that any new deal is researched well before being entered into. Funds might not be returned once you send them to scammers.

3. Sending money to the wrong address

Tons of people make this mistake on crypto exchanges. Whether you got the wrong address or made an error with the digits, sending money to the wrong address is a huge mistake because the funds may not be reversed.

It can be confusing to remember an address because it has very many digits but ensure you double check the wallet.

Again, never send BTC to an ETH wallet or OMG to a CVC wallet. You can send tokens to MyEtherWallet as long as they’re ERC20 but not on exchange wallets.

4. Sending bitcoin to an Ethereum account (and vice-versa)

If you want to exchange bitcoins for ether, do not send directly to the Ethereum account. You have to use Coinbase, Bittrex, and Gemini or other exchange markets to exchange the bitcoins. Sending bitcoins to a MyEtherWallet should have the transaction rejected, otherwise, you just lost the coins.

You can exchange the bitcoins for ether using Changelly and then send to the wallet account.

5. Sending the same transaction twice because the first one is taking so long

In this case, you might end up making the payment twice. Just wait for the first transaction to be confirmed.

6. Not setting up a wallet password

Most users think that the best get-go option is to not to have or enable a password for their wallet. Without a password, it is easier for an attacker to hack the wallet. A password or passphrase adds an extra layer of security.

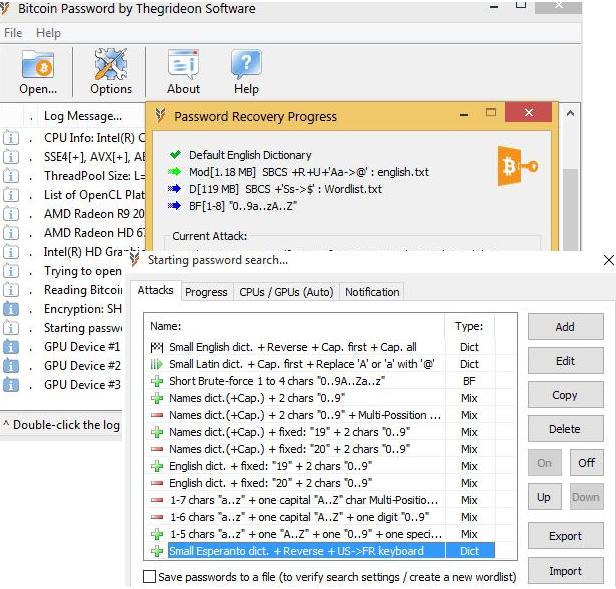

In most cases, you can recover a forgotten password or passphrase for the wallet through a private key is not possible to recover so ensure to have a back up of all, advisable on a hard copy.

The most common practice to deal with forgetting the password or passphrase is to note down the passphrase or save it in digital format on an offline device.

7. Cut and paste errors for wallet addresses

A new strain of malware tries to change the address and replaces the real address with a different one when it is copied and pasted. It means you will finally send money to the wrong address and lose it.

The said malware has a list of thousands of addresses and will select one that is closest to the address you actually are trying to send money to, so it might be hard to detect the change when you look at the address without some keenness. You should verify with the person you are sending to that the address is correct or at least check it manually.

Some cryptocurrencies add an extra feature where you can actually confirm by the photo of the recipient.

Read more on List of ICO Scam Techniques by Hackers and Characteristics of a Fake or Scam ICO to know more about this.

8. Not making a wallet backup

Your private key is what gives access to your funds and money will certainly be lost if you forget or lose the key. Making a backup is very advisable.

Most cryptocurrencies have features that allow very easy creation of a backup. You can create a wallet backup to an offline device that you won't be using.

Actually, the best way to do it is having a hard copy of everything. Make sure to write down all your passwords, private keys, etc., print them off, and store them somewhere secure. You can restore all your crypto to another device if your computer gets compromised, crashes or is stolen.

9. Being controlled by emotions when trading

Greed, fear, hope or excitement can be so overcome in the completely new world of cryptocurrency, whether you are trading, are faced with a security issue, or faced by scammers. Winning streaks can tempt you to enter into more deals with sheer hope that you fail to weigh the situation at hand carefully.

Fear might make you fail to enter into the next deal if you just lost a good amount of coins in a previous deal. But Fear of Missing Out (FOMO) is particularly common among newbies who want to enter into every project without any thought, for the thrill of making money.

Boredom or need to trade can sway your judgment easily as will the lack of interest in trading. Never force a trade in a low season. Wait! Greed might make you a victim of scamming. It is necessary to practice resilience, use every situation as a learning experience and always gather truthful information before going in or out of a project.

The worst thing about trading with emotions and panic is that most of the cryptocurrency dealings are about pumps and dumps and not making a correct judgment is a big blunder in crypto trading. Manipulating experienced users use all their tactics to lure, to their own advantage, anyone to sell or buy when they should not and most newbies fall victim to this.

Generally speaking, patience is most rewarded in crypto trading, so you might need to practice holding your coins as well even when everyone else is selling out of fear. Fear is common among people looking to making a profit out of short term trades. Otherwise, it is possible to make profits out of short term profits but make sure to have a plan and stick patiently to it.

Lack of patience and exit plan can make you sell off thinking that the price is too high to hold or HODL. But there is no price too high to hold your currencies.

Doing some basic research on what is causing pumps and dumps can help make the right decision.

Read more on 12 common mistakes in crypto trading

10. Not joining a community to learn from

Joining a cryptocurrency community, whether developed by a cryptocurrency that you are part of or in forums such as Bitcointalk, org will help you get free support from experienced and expert traders and investors. You get alerts on scams, pumps, dumps, support, and encouragement in addition to knowledge.

However, do not completely rely on the community without doing your research because propaganda that leads to pumps and dumps sometimes start in forums.

You can try such communities as Decred Slack, SingularDTV Slack, Crypto Twitter, and r/ethtrader.