Investing on a long term still the way to go in crypto

Investing in cryptocurrencies on a long or short term and trading of cryptocurrencies can all yield good results if done the right way and if the right motive, goals, and methodologies suited for each investment vehicle are applied. But in many cases, seeking excessive profits through day trading may lead to the trader taking excessive risks and this would end very badly. At the same time, using a speculative mindset during a long term investment may not end very well.

Which is your most preferred? Nevertheless, many crypto traders also do mix both.

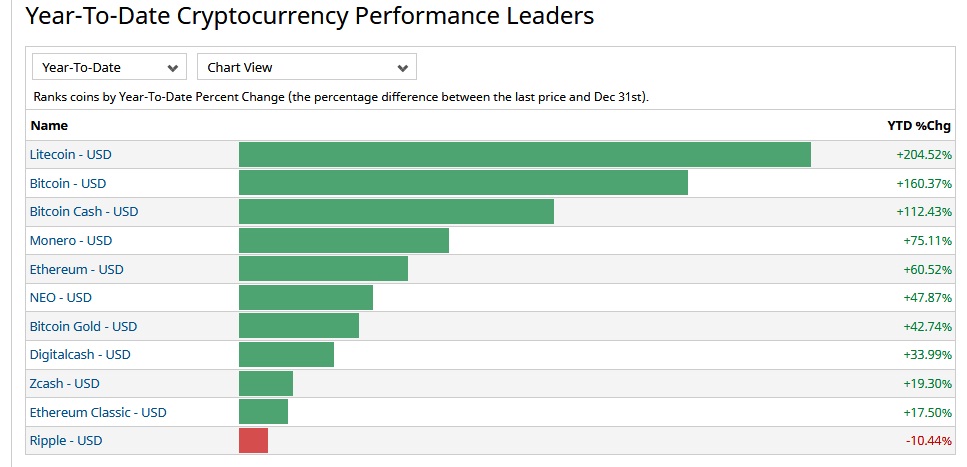

A check at performance statistics reveals that long term investment in crypto or the commonly referred to as "buy and hold" would have yielded huge positive returns. The statistics show that ignoring the short bursts in prices in-between weeks and days, the trend in these statistics favor long term investment in crypto, indicating that a 3-month to 1 year would be ideal for investors favoring long term investment in cryptocurrencies. For instance, the up-to-date year-to-year percentage change in prices are all positive for all the major crypto, sometimes up past the 200% mark depending on the individual cryptos.

Investing in Bitcoin, Bitcoin Cash, and Litecoin over a year ago and holding to date would have yielded over 100% and up to 200% so far.

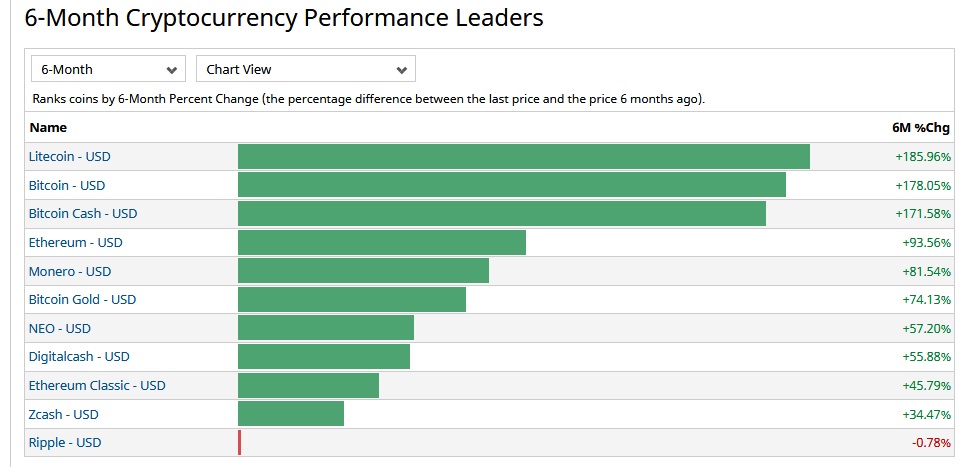

The same case applies for an investment period of 6 months during the time when Litecoin gained by over 180%, Bitcoin by 178% and Bitcoin Cash 171%.

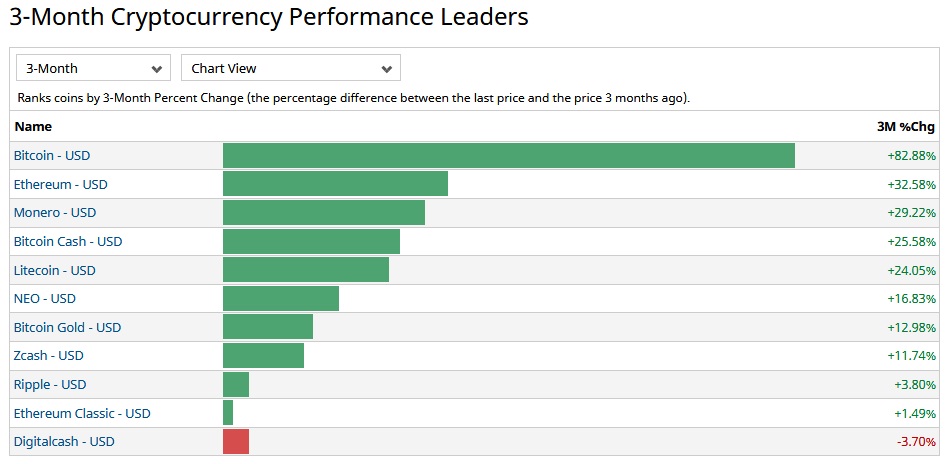

A three-months chart also tells the same story. Bitcoin led the gainers by 82%, Ethereum by 32% and Monero 29%.

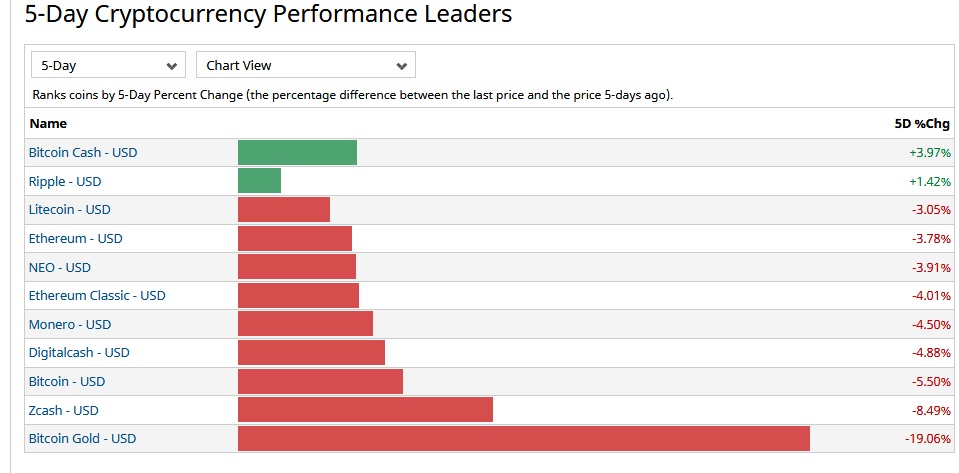

However, short term statistics tell a different story: starting with statistics for a one-month change in prices. Over the same period, Bitcoin lost by 21.52%, Bitcoin Cash by 26.51%, Ethereum by 31.77% and Litecoin by 24.53%. This decrease is mirrored in the 5-day chart as well long term investment in crypto, which is essentially "buy and hold" is still popular and it depends on when you get in and at what prices.

Of course, this does not mean that if we sampled one month, one day or 5-days in say the month of June or July or January this year we would have seen the prices falling and investors investing on a short term during all those times would have made losses. No. Not necessarily. Rather, the 5-day, and one month charts reveals that prices have generally been falling in the last 5 days or one month.

However, the one-year, 6-months and 3-months charts reveal a tendency that investing in the long term would have certainly yielded positive results.

Long term investing in crypto is an idea supported by many people and other developments in crypto in general. In February this year, Cambridge Associates, a major wealth manager for pensions and endowments, which advises major institutions who manage more than $300 billion worth of clients’ assets, said it believed it worthwhile for investors to "begin exploring this area today with an eye toward the long term" despite the high degree of risk and the challenges. The firm, however, went ahead to advise willing investors to do an industry-wide and deep investigation on the various aspects of crypto before investing, from investing in venture capital to trading tokens on exchanges.

Cambridge said despite the turn downs of 2018 that raised questions about the future of crypto assets, a look across the crypto investment landscape showed the industry was "developing, not faltering.”

Plus there have been several indications and evidence that many institutional investors have been eying the crypto industry this year, and in most cases, these have long-term goals and targets. Thus long term may be the way to go when investing in crypto.

When "long-term"?

Long term investment in crypto, which is essentially "buy and hold" strategy is still popular and it depends on when you get in and at what prices. It suits traders who may find they do not have tolerance for the hefty intra-day volatility of the crypto market; it also suits when a person is investing in a crypto that has a real-life use case with potential for adoption by the masses in the future say when the technology matures; and when the investment is done or is to be done at the lowest risk possible or when prices are at their baseline levels. The last condition makes it suitable for an ICO token but then again most ICO tokens later fall in price.

However, long term investment in crypto can suit any crypto especially when its at the end of a bearish period. That means buying a coin at its lowest price is not necessarily the only way into starting long term investment; many crypto projects are yet to reach their full potential and user adoption and that takes time.

For day-traders, the trick is to capitalize on short intra-day bursts in prices relying on the entries and exits as determined through procedures such as technical analyses. Day-traders can also rely on margins to increase their profits.

This is good