Top Cryptocurrency Index Funds You can Invest In

Cryptocurrency index funds are mutual funds meant to track returns of a group of digital securities in a given market. Cryptocurrency indexes allow you to track the performance of top coins and tokens (basket) in the market. These funds can either be actively managed – meaning they hold a basket of cryptocurrencies and then actively trade them to get the profits and share with investors – or passive meaning they do not actively trade the basket of cryptocurrencies.

A common way of investing in these index funds is to buy shares – normally termed as “buying into” the fund. This means you do not buy the coins themselves but the shares in the fund to share the profits later. That means the expected individual returns and potential for value growth is something you would want to look into before proceeding to buy into them. Essentially, most of them also try to capture the most popular tokens or coins in the market in their lists, so you might hear them say they list assets that carry 85% of the market value (based on individual cryptocurrency’s market capitalization), etc.

Market capitalization is only one factor they consider when deciding which tokens or coins to list in their baskets. Some will list all. Other factors taken into account include eligibility criteria, inflation adjustment of market capitalization, distinguishing circulating supply, rebalancing policies, composing price data, data sources, and policies for hard forks and other rare events. Inflation adjustment of market capitalization is determined by a formula that itself considers different factors. An example is the formula inflation adjustment of market capitalization = (composite price) x (circulating supply + additional supply publicly scheduled for the next 5 years).

Nevertheless, many cryptocurrency traders and investors alike use indexes to estimate the returns they expect in the future from their individual token and coin investments. They also allow you to invest in the economic growth of cryptocurrencies with a lesser headache – by buying a basket of coins.

And of course, most of these indexes have their own tokens, allowing you to buy into the investment either through an ICO and/or buying and holding the tokens and watching their value grow. The tokens and shares can be exchangeable in exchanges or through peer-to-peer trading. Some others have added specifications such as a minimum amount that you should put into the index fund investment and fees for trading services.

Why you should care about crypto index funds

For instance, you can use a cryptocurrency index to invest in and manage cryptocurrency assets either manually or through a management platform such as Iconomi. If doing it manually, you can use an index to track top ten tokens and then say allocate $1000 to the top ten tokens in the index. You can then use weighting where you weigh (assign a value of weight) a token based on its performance potential. The weighing is informed by extra information about the cryptocurrency say historical performance, public interest and development activity, prospects in the current market, etc. If you do not want to do all that manual work, then tools and platforms that do that are available and then allow you to invest in a basket of tokens based on their estimation of returns to expect – see our list of index funds.

Plus the liquidity is a nagging issue for cryptocurrency investors. Institutional investors may want to pay premium due to this. For instance, some index funds have come up with a solution to the liquidity issue using gated redemptions from the fund to quarterly intervals with a 30 day notice. However, investors may still fear the asset-liability mismatches such that if they request funds and the gated redemption requirement means they get the funds after four or so months, would they receive their funds with their value adjusted to current prices (which could be up or down)?

Investing through an index fund can be a good thing for a crypto trader but under certain circumstances. First, many will actually give you better returns than when you own and hold a single cryptocurrency. Also, high volatility comes with the risk to traders and investors and therefore you might want to minimize incurring volatility-related loss by dispersing your capital across an array of coins and tokens. Minimize because avoiding the effect of volatility is definitely impossible at the current state of market.

In addition, excessively frequent trading is associated with high fees and some performance drag. Additionally, some cryptocurrency traders simply do not have a lot of time to investigate how each crypto in order to invest in them. For some traders and investors, a crypto index fund may be one way of staying away from leaning on an unproductive mindset and opinion about a given digital asset.

Besides the above benefits, an index fund is good for a passive investor interested in maximizing long-term benefits of investment in cryptocurrencies by keeping the value of investment to a minimum.

Below are some of the top cryptocurrency index funds that you can track and may be invest in:

Bittwenty

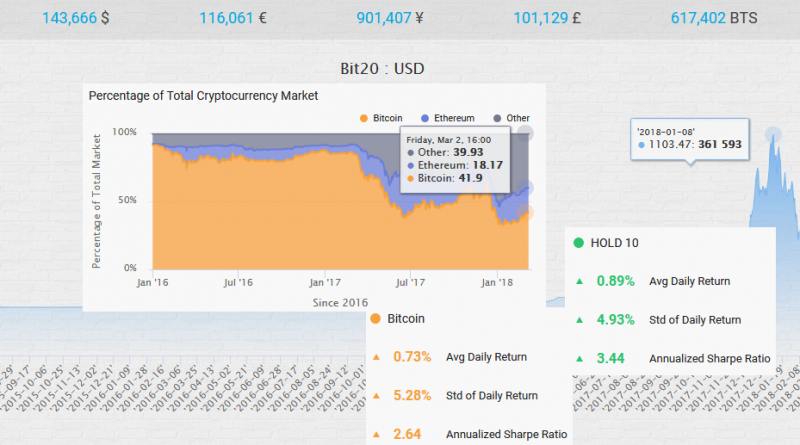

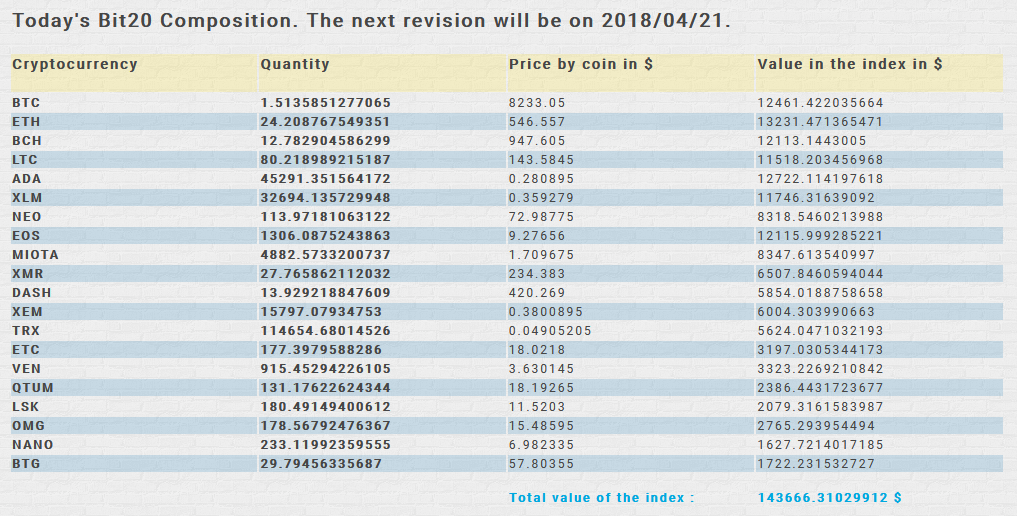

Bittwenty is owned by BitShares, which is a decentralized exchange. It was launched in December 2016 and was one of the first indexes in the cryptocurrency markets. The index tracks performance of top 20 cryptocurrencies and has the BTWTY token as an investment vehicle.

To invest, you simply buy some Bitshares by opening an account with them and transferring Bitcoins as per this guideline. Trading operations on the BitShares ecosystem attracts a fee of around 0.1 BTS. The fees goes to the development of Bittwenty, the website maintenance and future evolvements, publicity and other undertakings meant to grow the market.

Coinbase index fund

Coinbase announced recently that it will launch a passively managed Index Fund to allow investors exposure to all assets listed on GDAX cryptocurrency exchange. You must be US accredited and have a minimum of US$10,000 for the investment in order to participate. The fees will be 2 percent annually.

Currently, it has four coins and will add more in the future. Below is their initial distribution of the fund.

- Bitcoin – 65.79 percent

- Ethereum – 22.84 percent

- Bitcoin Cash – 7.43 percent

- Litecoin – 3.94 percent

Coinbase has a service called Coinbase Custody, which aims to store Bitcoin for institutional investors.

Crypto20

Crypto20 started in April 2017, held a pre-sale and then an ICO for the C20 token. It has a value of around $47.5million. For those who missed the ICO, you can buy the token and trade it at a variety of exchanges including Bibox, IDEX, HitBTC, and ED.

The fee is 0.5% management fees and there is no exit fee. The company offers a variety of coin options and their allocation is as shown.

Bitwise

Bitwise Asset Management runs the Hold10 index and tracks top 10 cryptocurrencies on a rolling basis. The company “weights these currencies by inflation-adjusted market capitalization, taking into account the supply inflation schedules for the next five years.”

The private vehicle allows only US citizen and “accredited investors” who can meet a minimum of $10,000 for the fund. The annual passive management fee is between 2% to 3%.

Bitwise was up by up 692.5% in 2017 meaning it was doing very well.

Iconomi – BLX

Iconomi – BLX is an index that packs in tools to allow beginners and expert traders and investors to invest in and manage digital assets. It is managed by Columbus Capital Ltd.

It offers a simple, user-friendly option for people who want to take a shot at a combination of assets. This is done through their Digital Asset Arrays (DAA). With DAAs, anyone can create an assortment of specific digital assets and then offer them to his or her supporters. Therefore, people can customize and buy into customized assets.

It lists coins that represent 78% of the sector by market cap. Read this guide on purchasing BLX.

Cryptos Fund

Cryptos Fund, the first regulated cryptocurrency fund in U.S. launched the CCi30 cryptocurrency tracker on April 12 to monitor top 30 cryptocurrencies including top 30 cryptocurrencies, including favorites like Bitcoin, Ethereum, Ripple, Bitcoin Cash and EOS. It accepts savvy investors who require a minimum investment of $10,000 into the fund. It attracts a management fee of 0.99 percent depending on the size of your subscription.

William Mougayar High Growth Cryptoassets Index

William Mougayar High Growth Cryptoassets Index tracks a basket of 15 digital assets. They state that WMX comprises of a strategic selection of cryptocurrencies that are “undervalued and exhibit long-term blue-chip-like growth potential across a variety of emerging sectors, including protocols, marketplaces, services, and applications where token-based transactions enable the business model.”

Rebalancing is done monthly to add or demote assets.

Digital Currency Index

Digital Currency Index tracks 30 significant digital currencies.

AgreCoin

AgreCoin compiles the top 6 coins in the market at any given point. The list becomes their fund. It helps, according to their website, to minimize risks in crypto investments while giving investors gains from the major coins.

Basically, they purchase the top six volume based coins, 1/6th each, daily, based on the new funds received. This is an example of an actively managed index fund. Plus there is an option – the UpStart1k – which manages the bottom 1000 coins or digital assets or tokens by buying them and distributing profits to investors. This option is much less risky than trying to pick the favorites.

Astronaut Capital

Astronaut Capital packs in own ERC20 backed token that lets you invest in “high volume and high demand crypto startups that are nearing a liquidity event.”

The token is the gateway to a managed portfolio, which investors can buy and speculate ability to earn quarterly income bonuses and capital gains. It has iOS and Android apps for live updates on portfolio.

Symmetry Fund

Symmetry Fund is an actively managed index fund that deals with investing in ICOs and cryptocurrencies including Bitcoin, Ethereum, Ripple, Dash and Litecoin and then paying Dividends. 50 percent dividends are paid out monthly to wallets while 50 percent is compounded for the fund’s NAV growth.

Nevertheless, SYMM shares can be traded between peers or on other exchanges. Anyone can check the fund’s reserves and market value at any given time. Investors can also participate in shareholder votes.

Digital Developers Fund

Digital Developers Fund it invests in a spread of digital assets including domain names and cryptocurrencies. The platform raised $2 million in their August ICO for the DDF tokens.

The audited fund invests in crypto currencies with at least 100m USD market cap that are listed on at least three audited exchanges.

Others index funds include the CAMCrypto30 by Crypto Asset Management; and Crypto20 which has no broker fees, no exit fees, and no minimum investment while giving you a full control over your assets.

For research not investment

Here are some indexes to watch out and which are meant for research and not supporting investment for now.

The main ones in this category include CoinMarketCap and WorldCoinIndex,

FS Crypto FX indexes

FS Crypto FX indexes were launched by Fundstrat co-founder Thomas Lee for institutional investors. He launched five indexes to help track 630 digital currencies. Tokens are split into five groups by market capitalization and trading volume.

The five are as follows;

- FS Crypto 10 which tracks 10 largest and most liquid cryptocurrencies including Bitcoin, Ethereum, Ripple, Litecoin, Dash, IOTA and Monero.

- FS Crypto 40 which tracks top 11 to 50 digital currencies by market value and liquidity including NEM, Bitconnect and Lisk

- FS Crypto 250 which tracks top 51 to 300 cryptocurrencies by market value and liquidity. These include BitcoinDark, Singular DTV and FirstCoin.

- FS Crypto 300 for the 300 largest digital currencies by market value and liquidity

- FS Crypto Aggregate for 630 digital currencies