This platform helps SMEs to finance their invoices on blockchain

Many businesses use invoice financing to grow. For starters, a business in that case will use their slow-paying invoices from creditworthy customers as collateral for financing or a loan and hence access the money immediately. A business can thus cover their expenses in the present and the loan in future.

The company's customer who is expected to pay the company, will receive Notice of Assignment about the invoice financing transaction.

Banks and financial institutions usually facilitate invoice financing also known as factoring, a sector expected to increase at a compound annual growth rate of 13.3 percent from 2018 until 2022. However, the cost of it is higher even than all the other types of funding. Banks, in the traditional invoice financing process, will also require to manually verify the invoices with the customers and this can take time if it is more costly for the financing institution.

When a bank or intermediary such as a bank is involved in the invoice financing transaction, they are paid to assess the risk of the transaction. In the traditional setting, this takes time because the assessor relies in documents such as annual reports.

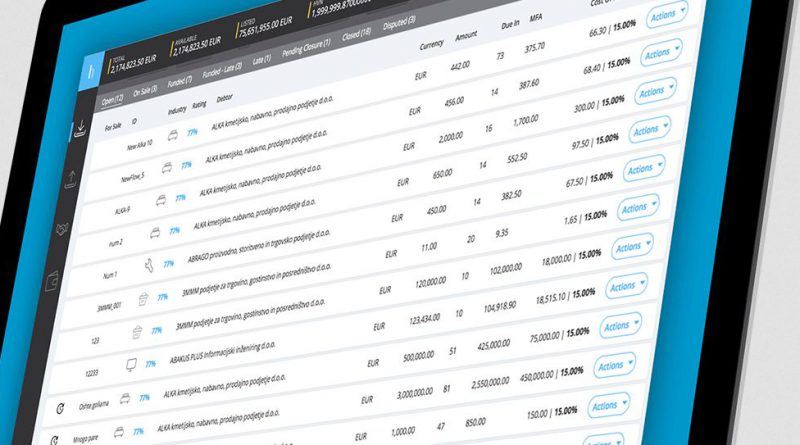

Hiveterminal went live last week to help startups or small or medium firms looking to finance their invoices, but in a different way. It intends to use blockchain for a platform that connects invoice buyers to invoice sellers. Invoice sellers will find the most needed cash while invoice buyers will invest with the funds to get returns that they could not get if their savings were tied up in a bank account. The financing can be paid in cryptocurrency HVN or fiat.

Currently, companies from Slovenia are able to upload their invoices and get instant and free liquidity from invoice buyers from around the world, said Hiveterminal Co-founder and CEO Jure Soklic. HE said earlier this month that they had secured partnership with the largest representative body of artisans and SMEs in Slovenia, which has more than 52.000 members. So for investors, everyone can participate in such kind of an investment, compared to the exclusivity-based invoice financing model used by banks.

The company is also hoping to enter new markets meaning companies in other countries they start operations can also finance their invoices using the platform. Every invoice issued on the platform will get a unique fingerprint and the uploading firm does not pay any fee to source for liquidity. Once the uploaded invoice gets financed, the funds are sent to the company immediately.

For the investors, or the invoice buyers, they can browse through the invoices to find high-return investment opportunities and those that suit their risk appetite. The person financing the invoice on a peer-to-peer basis will then wait for the invoice due date and receive the full invoice amount directly from the invoice seller's debtor on that date. They generate a profit from this activity. For instance, if a buyer is financing a €100 invoice with 90 days maturity for a 9% dsicount, they will pay €91 to the invoice owner and a 1% fee to be paid in HVN, making a profit of €8.09. The real-time risk scoring algorithms will help the investor assess the risk of the investment.

On the other hand, those looking for invoice financing are also able to set the rates at which they want to borrow and thus can manage the costs of the financing on their own.

The startup's platform will also integrate corporate intelligence data sources, a proprietary scoring algorithm, and an ERP data module to facilitate real-time invoice rating. This rating will help build a culture of trust between invoice sellers and buyers. It also wants to develop into a marketplace with advanced trading analytics for peer-to-peer lending. The platform will not only help small businesses to create a database of invoices for scoring and auditing, but will also help carry out credit checks and facilitate rapid and real-time auditing.

The system can also generate a company's credit score that can be provided to auditors, banks and government authorities to give an accurate and real-time picture of your company's financial health.