To Do Crypto or Forex Trading? Here are Major Differences, Pros and Cons for Each

Crypto and forex or foreign exchange trading are similar in multiple ways: they both involve trading and exchanging of currencies. If you were looking into which one to do, we got an entire list of things you can consider, the challenges, benefits and drawbacks for engaging in each.

Forex is still a considerable choice for those willing to invest in regulated currencies, hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, and other styles. Managers, commercial banks, central banks, money managers and hedge funds are the main participants in this market. In contrast, there are a higher percentage of individuals who are doing cryptocurrency trading.

Plus while forex -- like stock -- trading would be more viable for those looking for more stable and regulated assets, crypto is preferable for those who love to trade market volatility and where there is very few to no barriers of entry and low capital and investment requirements.

What differences would you encounter between crypto and Forex trading?

The major difference between the two is that while crypto trading is relatively new, forex is well-established all with its brokers, middlemen and it has much better institutional adoption. Forex has so much liquidity, with trillions of USD traded in a day, when compared to crypto especially with the lesser popular coins, and there is also the issue of security of investments.

Besides, forex is regulated industry and a mature market with brokers located and distributed in nearly every country.

All these present major advantages for anyone wanting to venture into Forex trading.

Probably the main drawback of Forex when compared to cryptocurrency trading is the cost with trading, with it getting more expensive to trade even before the trader can start getting profits. Forex requires substantial capital before you can get get started. Besides, Forex has low price variability or volatility for individual currencies, making it lesser attractive than crypto for those who want to trade violatility.

Again when compared to cryptocurrencies, Forex's large establishment world-over is its drawback in a way because individual traders are competing against well-established institutional Forex traders and banks. Although cryptocurrency market also has well invested institutional traders and high-frequency traders, the extent of competition is somehow limited compared to forex trading.

In both cases though, one would require a high level of engagement, equity planning, proper risk management, perseverance and a strong desire to continuously learn. In both cases, educated investors have high chances of winning.

Here are some reasons you might want to engage in Forex trading compared to crypto trading

1. High liquidity

Trillions of money are now already invested in Forex trading and each of the pairs sold and bought on the forex market represents high liquidity, meaning the easy with which each single cryptocurrency can be traded for another, instantly.

Whether you are trading local currencies in world's most remote places or internationally-established currencies like Euro and USD, it is easy to find ready market and the high daily turnover means orders get filled instantly. Another advantage of high liquidity is that it reduces the role large traders play in the market. Large trades will not overly change the asking price of a given trade.

In cryptocurrencies, lack of liquidity is common for many of the cryptocurrencies from the 5000+ cryptotokens and digital assets available. Large traders always lead price manipulations.

2. Security concerns: Forex is fully regulated

It's a major problem with investing in any valuable asset, that there is risk of loss from manager or trader malpractice or errors caused by exchanges and platforms where money is kept. There are many cryptocurrency exchanges that have been hacked so far leading to loss of millions of dollars although again more has been lost in breaches related to Forex.

While breaches on crypto stuff can be tracked, and a majority of platforms will refund money anyway, there would be lots of trouble because of the loose nature of regulating cryptocurrencies as a separate subject from assets and commodity law/regulation.

In some cases, it is not certain that the cryptocurrency platform would even refund the money in case of a hack, internal errors or malpractice or other circumstance that lead to a loss. Apart from hacking practice and errors, lots of malpractices and scams in cryptocurrency may lead to loss of individual funds where the investor or trader does not do due diligence. Accompanied with the nature of blockchain technology that offer no method of recourse or reversal of transactions.

In comparison, Forex transactions are governed by regulations and some level of protection as a requirement. Brokerage accounts also are insured by governments in the event of a theft or fraud.

For these reasons, Forex transactions would appear to be secure and safer for those traders prefering a regulated investing environment. The fact that it is regulated explains the so-seemingly better trading conditions for forex because there are clearer guidelines on how to proceed with all nature of transactions.

3. What influences prices? more stability for Forex

The exchange rate of currency pairs play to economic development, political uncertainty, fiscal policy, central banks’ interest rate decisions, or even weather factors.

4. Market capitalization is huge in Forex markets

Market capitalization being huge means there is greater liquidity, depth and stability, and this applies either in BTC or Forex transactions. Forex is far the largest marketplace in the world by market capitalization and the trading volume is in the tune of $5.1 trillion per day compared to $84 billion for equities worldwide.

The high volume in Forex trading is attributed to the high public interest facing the seven major global currencies. While volatility may be more preferable for those trading volatility, relative pricing stability ensures that people who are trading something else aren't losing too much of their investments. As such, they are able to remain in the market for longer.

The United States Dollar is largest traded in volumes at the tune of 89%, Euro 31%, Japanese yen 22%, British pound 10%, Australian dollar 7%, Canadian dollar 5%, and Swiss franc 5%.

5. Extensive leverage

Like there is in cryptocurrencies, there is considerable leverage in stock ranging from 50:1 up to 100:1 margins. Same applies in cryptocurrency trading.

Here are some reasons you might want to engage in trading cryptocurrencies

1. High differences in exchange rates or price differences between crypto

Because there is high variability in cryptocurrency prices with those prices changing quickly every other minute and second of the day, crypto trading is now a major attraction for traders who are trading volatility. Huge volatility for traders who trade volatility means it is possible to buy low in the morning and sell high a few hours later.

For instance, if you were trading stock markets, you could make a 5-15% ROI while Bitcoin would yield 12 months ago would yield approximately a 144% return. High volatility in crypto markets explains the gaps and slippages which are rare in forex trading except for those trading exotic currency pairs at low-quality brokers.

The high volatility may present a problem for some traders, it's true. However, as prices get influenced by day-to-day and minute-by-minute happenings such as news and events that are beyond individual traders' control. In fact, part of the problem in this regard is manipulation because large institutions and companies can manipulate easily by way of propaganda, ad payments or through news outlets since they have huge following and given the low market cap for majority of crypto.

With cryptocurrencies, however, we have quicker and more dramatic changes in prices which is influenced by things like news and events.

Although volatility is high in cryptocurrencies, large coins do well and the volatility was still decreasing. In deed, over the years, Bitcoin, for instance, has seen less dramatic volatility shifts with sometimes being more synonymous with traditional currencies. This is even as more exchange continue to witness deeper liquidity, more people understand Bitcoin pretty well, and after increase in the overall confidence in long term viability of network without panic-induced buying and selling.

2. Lower barriers to entry

Cryptocurrencies are not just easy to buy by individual traders but also do not require registering with brokers as would Forex trading. Plus many online platforms have less to no requirement for identification because crypto is strong case for remaining anonymous on the internet.

The reason BTC and crypto investments and trading have low cost and barrier of entry is because there are no intermediaries in the classic sense as in the case in foreign exchange markets. In cryptocurrencies, it is easy to enter the market with lesser than $50. You can then take advantage of higher volatility in crypto than there is in stock or Forex markets. This provides more opportunity to earn more profits. In stock and forex trading, companies that offer trading services require a great deal of information and sometimes even a declaration of "professional investor" status. This adds more costs and delay.

Beginners in both cases would need to spend some time to understand the art. However, it is easier for a beginner to learn cryptocurrency trading from scratch before they can get started and earn some profits. Paper trading is also possible in cryptocurrency trading as much as in Forex trading for those trying to learn to trade.

In comparison, there is a higher learning curve in stock and forex trading. With stock and Forex trading, there also will be lots of paperwork and associated costs before you can start trading. Additionally, making the first profit is also going to be very difficult in crypto trading.

3. Lots of currencies and pairs to trade in

There are now more than 5000 cryptocurrencies and altcoins and digital assets. This presents one advantage for crypto traders; they are are able to choose from a variety of tokens and crypto for which to trade against each other. So if it's a dark day for Bitcoin, one might check if there is relieve in Ethereum or some other low cap coin.

Diversification is as real in crypto trading as is in stock or in Forex markets. It depends on one's ability to build a workable and beneficial crypto portfolio.

4. High leverages

Like is the case with Forex trading, one is able to trade on leverage means they do not need an instantly large amount of crypto to be able to eye huge profits on a trade or several trades. In crypto as much as Forex trading, traders are able to invest a little amount of capital and harvest more profits than they should have with disposable capital because what leverage does is to loan out money to the trader to buy more or enter more (or larger) positions.

Forex also does have leverage and leverage also means that traders can lose big if markets are moving against their bet.

5. Available 24/7

Without centralized governance of the market, and with most of transactions taking place directly between individuals, crypto is traded 24/7 without market closures. Even crypto exchanges do not have closing times. This is compared to stock or other markets than do not run on weekends or holidays. Forex market, for instance, is available 24/5

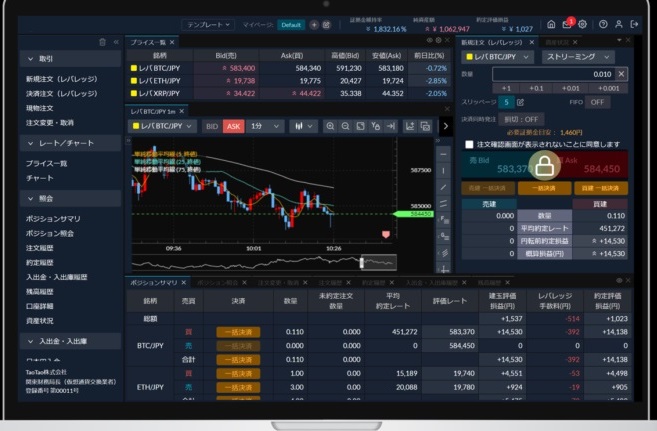

6. Availability of tools for trading and investing

In both cryptocurrencies and Forex trading, there are so many external tools that can aid traders in the making of more and more profits as they advance their art. Probably, there are more tools, including advanced tools, for those who want to start trading forex than there are for those willing to start trading crypto.

However, it is harder for individuals to recognize, analyze, and capitalize on trends in the greater stock and Forex market. This is not so with cryptocurrencies where prices increase and decrease in a much more tied version to one another and related to each other.

Thus, in cryptocurrencies, experienced traders can effectively predict the movements in the market but with stocks and Forex, it may be difficult to predict the larger issues that move markets. What it means is that although it is possible to do analyses to project crypto prices, it is harder to accomplish that it is in cryptocurrencies.