CREX24 Review

CREX24 is a Russian-based cryptocurrency exchange launched in 2017 and which aims to provide services for beginner and experienced traders, with 24-hour support and features such as unlimited deposits and withdrawals for both fiat and cryptocurrency, listing for rare cryptocurrencies and charting. In addition to listing very many coins, the exchange also supports trading for rare pairs unsupported or not listed on other exchanges. Market makers also get extra remuneration or rebates.

Currently, the exchange supports trading for around 150 coins and altcoins including BTC, LTC, DOGE, DASH, ETH, ZEC, XMR, XEM, GAME, BCN, DGB, BCH, ETC, BTS, XGOX, Monero and BTG, which can be traded for USD, EUR, JPY, CNY and RUB. Customers in the EU and the USA can only trade crypto to crypto and they cannot trade crypto vs. fiat. The exchange also supports trading of assets such as Diamond and Gold.

From this link, you can also watch the current status of your preferred cryptocurrency on the exchange including the number of deposits and withdrawals that are pending confirmations, the connections that a particular crypto has on the platform, the last block date and last check, the latest deposit and withdrawal, the last block number, and whether deposits and withdrawals are active or online for that particular crypto.

The exchange is currently managing around $1.5 million in trading volume. It is led by a youthful team that has experience in cryptocurrencies.

Features

Fiat-to-crypto and crypto-fiat exchange

You can deposit fiat in order to buy a cryptocurrency and can still exchange your crypto to fiat on the CREX24 exchange. However, there are deposit restrictions on bank cards: cards issued in the US cannot deposit or withdraw on the exchange while Russian Mastercards are not available for withdrawals.

How the exchange feature works is by a user posting order and it is filled by a buyer, including the orders to exchange crypto for fiat. You pay some fees to have the order placed on the exchange and filled by matching and there is no guarantee that a buyer will be found for your offer. The exchange does not work like a DEX exchange to exchange crypto for fiat and does not allow the transfer of funds between customer's accounts.

Trading features

Deposits and withdrawals

First of all, deposit and withdrawals on the exchange are also charged depending on the amount deposited or withdrawn and the payment method. The minimum fee rate is 1.5% and the minimum deposit is $1. The exchange supports a variety of payment methods for withdrawal and deposit including bank cards, e-wallets (Skrill, WebMoney, Yandex Money, Qiwi, Perfect Money) and electronic payment platforms (Neteller, Payeer, etc.).

The duration of deposit and withdrawals is also dependent on the currency and payment method.

The minimum fiat deposit is 1 USD and fiat withdrawal is 3 USD. There are also some limitations on bank card transfers depending on your location as mentioned earlier.

Trading fees

Market makers, or the people who create liquidity, or rather still, the people who place orders for selling on the platform, do not pay any fees to list their orders. Instead, they get rebates depending on the volume of their trades as calculated and adjusted every 24 hours based on the customer's trading volume in the past 30 days.

The amount of rebates is also dependent on the type of cryptocurrency the user is trading. For instance, Any amount less than 5 BTC is paid 0.01% and amount larger than or equal to 50 BTC in trading volume get a 0.05%, which makes it around 0.0250 BTC, which is not that bad. At the current dollar rates, you get $84 of commission for a 30-day volume of around $170,000 worth of BTC.

The commission or rebates paid to market makers is extracted from the trading fees paid by market takers, or the people who fill or buy the orders placed on the order book. The taker fee also depends on the trading volume calculated every 24 hours and based on the customer's 30-day trading volume. For trades of equal to or less than 5 BTC, the fee is 0.01% and for a 30-day volume of 50 BTC, you pay 0.06%.

Its multiple payment options are also a plus because some exchanges do not offer that kind of range of payment options.

Adding or listing of coins

A project willing to list at the exchange will pay around 0.03 BTC. The condition is that the coin has to be listed on Coinmarket.cap and provide liquidity until traders start to provide it themselves. The document for requesting listing is filled online.

Charting tools

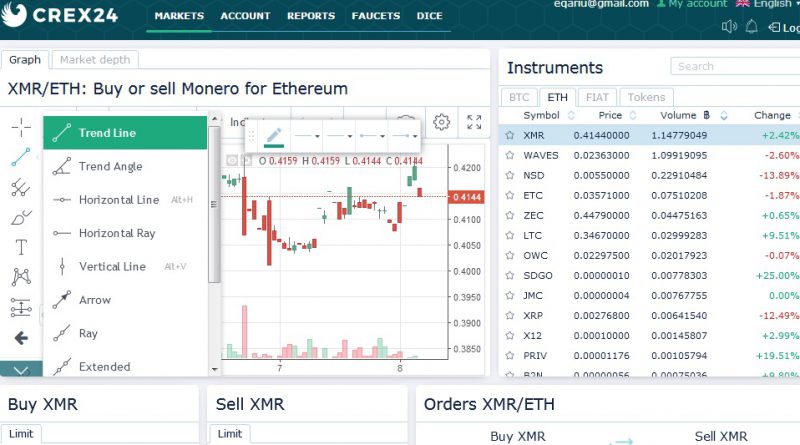

With the crypto exchange's charting tool, you can monitor the performance of individual cryptocurrencies to make the necessary decisions that favor your trading moves. Quote analysis help customers make trading decisions.

The exchange rate chart allows customers to customize a number of things including changing the interface by 40 parameters, selecting graph type, setting time limits, and using 70 indicators.

To access charting tools for a cryptocurrency, you head over to "markets" from the main/home page and click on a particular pair. For instance, the XMR-ETH pair can be found on this link. On each pair, you are able to buy or sell, and check the best ask and best bid for the pair (for instance the best ask to buy XMR for ETH was o.04144 at the time of writing), view all the orders for the pair including the total amount for both the buying and selling sides, and the trade history for the pair including price and the total order amount on any particular time of a trade.

The charts, indicators, and analysis tools from TradingView are available for each of the trading pair links when you sign in and want to trade. From the "reports page" on your account, you are also able to check your trading history, current and past processed orders and payment history.

A customer is able to also check and track price, volume, and 24-hor percentage change in price for every altcoin, coin and fiat pairs traded on the exchange. Having chart tools means it is better than exchanges that do not have these.

Security of accounts and assets

No breaches have been reported yet. For purposes of secure trading, the exchange provides 2FA account protection third parties prevention from accessing accounts, SSL, and DDoS to protect data. To protect customer's crypto and fiat, funds can be withdrawn only after user ID verification, crypto assets are kept in hot/cold storage, and fund withdrawals are suspended for up to 72 hours when personal details are changed. It also provides email notifications for any account sign-ins alongside the IP and user browser details and location.

Account registration

Signing up does not need any verification for participation to such things like faucets. However, the exchange has verification requirements for those willing to sell or buy through the exchange. It looks like it is an optional feature. Registration verification includes uploading a copy of passport photo ID page or ID card held next to customer's face, a copy of customer's face photo next to the bank card with details of the cardholder and names visible on the photo (for deposits), and a copy of customer's face with payment system and details such as the deposit payment transaction confirmation in the background.

Interface and usage

The website interface is basic and clear and basic for beginners and it is an easy-to-use platform. The signup process is also simple and very straight forward without many steps -- you only require email and email confirmation to sign up to the platform.

Support

The team offers 24/7 support in English and Russian and the platform supports 21 languages including Arabic, Czech, German, English, Spanish, Persian, French, Hindi, Bahasa Indonesian, Italian, Japanese, Korean, Malaysian, Dutch, Polish, Portuguese, Russian, Thai, Turkish, Vietnamese and Chinese.

Betting

On sign up, you can also bet on the platform either manually or via auto betting.

Upcoming improvements

According to their websites, they are developing iOS and Android apps. They also continue to list more tokens and offer more pairs, with recent additions being MNEX/BTC, ZAR/BTC, TPT/BTC, REVU/BTC, and SATC/BTC market pairs.

Disadvantages

The cryptocurrency provides no leverage for traders unlike many popular cryptocurrency exchanges of its nature. The limitations on withdrawals and deposits and restrictions on U.S. and EU based bank cards can also be considered a disadvantage since it would lock out some people.