Revolut signs up more than three million customers

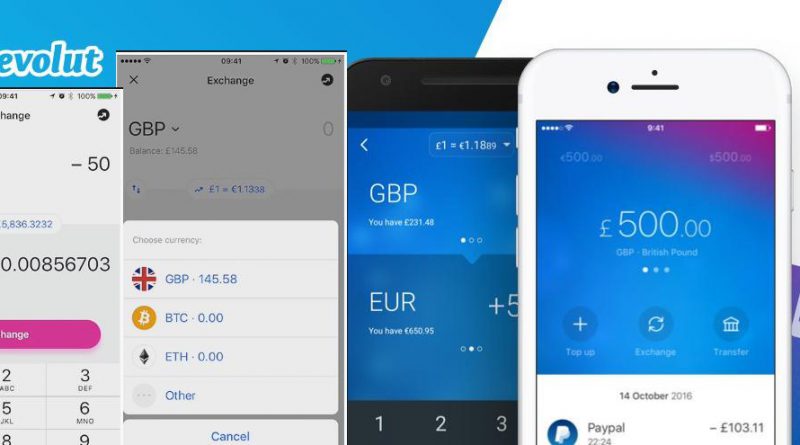

Revolut, which is a startup platform that serves as an alternative to traditional banking through its fiat and crypto payment and exchange offerings, has signed more than 3 million users.

This is according to a company's announcement on Twitter today.

"Three years ago, banks and investors laughed at us. Today, we have signed up 3 million customers and no one is laughing now. Thank you!"

The company, which refers itself as an electronic money institution and not a bank, initially did not offer cryptocurrencies services but proceeded to add them in because cryptocurrencies repeatedly featured among suggestions by their customers according to the company. It is one of the fintechs that are taking advantage of the increasing popularity of e-money and digital currencies with continued innovation of service. They are targeting at reducing the barrier to entry in crypto by offering a seamless exchange between fiat and cryptocurrencies within the app.

They started integration of cryptocurrencies by first trying out with buying, selling, sending and spending of Bitcoin, Ether and Litecoin and then later added more features including the exchange and more crypto options with addition of Bitcoin Cash for instance. The company does not think that the big institutions including banks will quickly enter into cryptocurrency space according to the founder and CEO Nikolay Storonsky speaking in a recent Web Summit 2018 in Lisbon. He also told Bloomberg that the fintech in crypto will be "very big" in the foreseeable future and banks would not catch up.

With Revolut, users can open an account using their mobile phones, from where they can save, make payments, transfer fiat and cryptocurrencies, exchange fiat for crypto and vice versa and withdraw money in ATMs in over 30 countries. But cryptocurrency is only a small constituent of all their operations. Apart from crypto offerings, Revolut customers can exchange/swap fiat at interbank exchange rate in order to spend their savings globally (for instance when travelling abroad) with ease. The company, which was launched in 2015, lets customers in over 30 countries to instantly exchange 24 fiat currencies via a mobile web.

Among its main crypto offerings are crypto saving plans in addition to the debit card plans to allow anyone to spend cryptocurrencies conveniently at different locations around the world. In the saving plan, customers can set up Vaults using mobile phones from where they can save cryptocurrencies and even set up recurrent payments to destinations of their choice. Customers can also transfer 5 supported cryptocurrencies to other Revolut users instantly for free although it does not support sending to other crypto wallets. They also do not support all digital cryptocurencies.

The company offers a free UK current account that comes with a free EURO IBAN account, and holders can spend their fiat savings in over 150 currencies. Holders of this account do not pay any fee for exchanging 24 fiat currencies for up to an amount of £5000/€5000 per month and there is no fee for ATM withdrawals up to $200 per month.

With the premium account that costs €7.99/m, users get (in addition to fiat-based services) exposure to 5 cryptocurrencies (Bitcoin, Litecoin, Ethereum, Bitcoin Cash and XRP) with the saving feature, exchange (for 24 fiat currencies), crypto sending for free, and ATM withdrawal options. They can also check real-time crypto graphs showing current rates and even set price alerts to be sent when a cryptocurrency hits a certain price. Cardholders can also manage their payments and purchases at stores. Users who spend fiat money including cryptocurrencies on their Mastercard payments, can get up to 1% cashback.

Currently available to a host of countries including Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland and the U.K., the platform offers a host of services including debit card withdrawals for cryptocurrencies. It is also planning to launch globally.