Top Person-to-Person Cryptocurrency-Fiat Exchanges

Most people have already heard about LocalBitcoins.com. A person-to-person or peer-to-peer exchange or simply P2P as they are called, is an exchange that brings together people with complementary currency exchange needs. That is, person A wanting to exchange currency a for b can meet person B wanting to exchange currency b for a. That exchange can facilitate crypto-to-crypto conversion or crypto to fiat. In this case, we look at exchanges that allow exchange of crypto for fiat.

Also known as decentralized’ exchanges, p2p exchanges run and on software to facilitate just like other exchanges, but participants can trade with each other without requirements for human middlemen -- not to mean there necessarily is no support though. Usually there is.

These types of exchanges arose due to the need for eliminating some limitations of the regular Bitcoin exchanges. For instance, while regular exchanges are still more preferable for majority of people buying crypto due to their vast number of advantages of P2P exchanges, they collect a higher amount of fees to facilitate arbitration in case of disputes and management of all the interactions between their users. Again, these regular exchanges carry other benefits over P2P because they offer extra lines of services than would many P2P as they were today. Again, most support more options than just Bitcoin as is the case with most crypto-fiat peer-to-peer exchanges.

How does a regular cryptocurrency exchange (the likes of Coinbase, Binance and others) work? A regular crypto exchange works by having people who are looking to sell Bitcoins specifying the sell price and all the requests or orders are placed in a common ledger called the "order book." People looking to buy Bitcoins can either look for a satisfactory offer in the order book or create their own "buy order" with the specific terms of the deal when no satisfactory order is found in the order book. The exchange will also work hard to match the buy and sell orders by price and then process these trades.

In some cases, these exchanges settle transactions immediately even when the actual transactions on the network are not fulfilled. Therefore, they can be faster than the P2Ps.

In comparison, a P2P exchange will work by matching people behind those orders in that when the buy and sell orders are matched, the people behind the orders arrange for other details such as payment methods etc. Modern P2P exchanges have arbitration teams as would be expected.

Besides being cheap, P2Ps offer high resistance to transaction censorship, are more private and secure. As would be expected, regular exchanges have regulatory impositions almost daily nowadays and there may be limitations for the countries they support. A good example is last year's problems that arose when China started banning cryptocurrencies: two of the largest exchanges in China China froze all Bitcoin withdrawals for a month. This is in addition to the issues that could arise on an exchange that stores Bitcoins or crypto on behalf of users although essentially, P2P exchanges also have escrow storage for coins these days.

However, arbitration could take many forms including reputation-based system of community arbitrators, obligatory deposits for the duration of a trade or face-to-face meetings between traders.

And while fiat money is refundable, not so with most crypto transactions and thus customers in a P2P that facilitates crypto-fiat exchange will always be exposed to fraud. For instance, a customer buying Bitcoins could send fiat to the seller via bank and later seek refund from the bank if the Bitcoin transaction settles faster than the bank transaction. Nevertheless, most P2P reduce that incidence by having to send Bitcoins or cryptocurrencies once the seller receives the money. Some have obligatory deposits where both counterparties have to deposit a given amount of crypto and these are returned to the persons when the trade completes uncontested.

Some also have arbitration process where a reputed arbitrator appointed by the community will hear the both sides of the argument and resolve it. Once resolved, the obligatory deposits are used to compensate the victim of the fraud and pay for the arbitrator's service. Other exchanges let an actual meeting of the two people occur to perform the trade and ensure it is is complete before parting ways, which limits trades to a given location.

Additionally, AML and KYC regulations are enforced on many regular exchanges as an oversight while P2Ps are less prone to oversight regularization.

In terms of their disadvantages, these P2P crypto-fiat exchanges deal with a small audience and thus their is a much low trading volume compared to regular types of exchanges. Again, it can take longer for a transaction to complete on a P2P. This is especially so because most transactions have to wait for actual match between crypto and fiat before a trade is complete. These types of exchanges -- the P2P -- also do have low liquidity, meaning they are not demanded for instance by professional traders. Most professional traders are looking for faster transactions to make timely deal and cash in on price changes.

LocalBitcoins.com

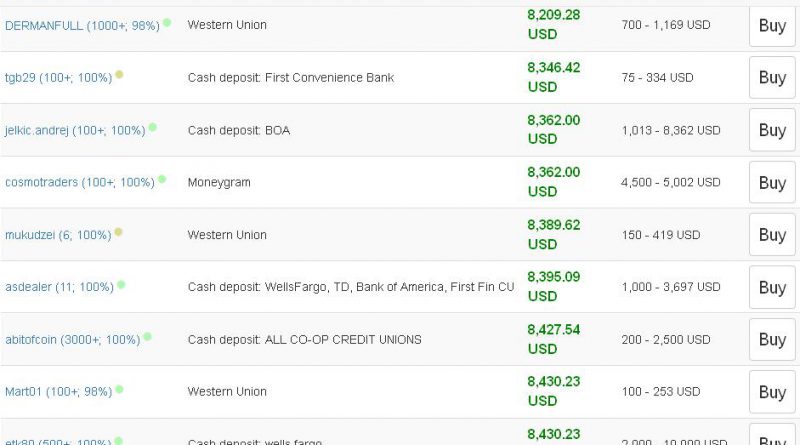

LocalBitcoins.com operates all around the world (in 16174 cities and 248 countries) but is not decentralized. With it, users from any nation including where crypto is restricted, can exchange Bitcoins for national currencies directly between themselves, a method known as over-the-counter (OTC) trading. It currently has more than 1 000 000 registered users. Additionally, the platform recorded a double volume within the last 12 months.

Those paying for Bitcoin can do so using a myriad of ways including PayPal, cash on hand, cash deposits, wire and other methods.

To sell on the platform, users create advertisements on the website as well as the terms of trade including the payment method they want to accept, the amount they want to sell Bitcoins for, the limits and the terms of trade written in form of a message. After this, the seller will have to fund their LocalBitcoins.com wallet with Bitcoins and this is needful for customers to open trade requests from your advertisements. You need at least 0.04 BTC in your LocalBitcoins wallet to have the advertisement shown publicly. Sellers can create up to 5 ads at a time (you can create one additional ad for each Bitcoin you trade during 30 days).

Sellers are able to manage advertisements on the LocalBitcoins.com account dashboard, as well as see which trades are open and which are closed. In setting the price, you can use price equation field to create a price algorithm and hence set the price based on a number of variables.

Users needing to buy Bitcoins browse for these advertisements with price and preferred payment method. After this, they contact the seller. Once the buyer opens a trade with the seller, the full amount of trade is automatically transferred from the seller wallet into an escrow. The seller then provides the buyer with payment instructions. After payment, the Bitcoins are transferred to the customer's wallet.

It has a reputation system for finding and filtering trustworthy customers. The buyer and seller are able to provide feedback for each other once the trade is completed. This affects reputation for purposes of future trading. The more trades and feedback you have the more trustworthy you are. Additionally, the platform allows for SMS verification and ID verification of accounts and verified accounts will get more trust from buyers.

The platform also packs email, SMS and web notifications when a buyer replies to an advertisement and when a trade is paid for.

Besides, the platform offers an API that you can use to automate your own trade deals.

LocalBitcoins.com also removes the possibility of fraud between parties by requiring the two to meet in person and conduct the trade. The two can ensure the deal is completed before parting ways. However, that would limit trades to specific locations.

For fees on trading on LocalBitcoins.com, see this link.

Bitsquare

Bitsquare, which is now more than three years old, is an open-source desktop application that allows users to buy and sell Bitcoins in exchange for national currencies or alternative cryptocurrencies.

It is decentralized and supports 22 payment methods including Western Union, bank transfers, OKPay, Alipay, Cash Deposit, Venmo, Swish, MoneyBeam, SEPA and Cash App. It also supports about 150 cryptocurrencies that you can exchange for.

Like most peer-to-peer methods, both users will create security deposits as an incentive to participate in the transaction. The deposits are locked into a multisig escrow along with the Bitcoin being traded and will be returned once the trade completes successfully. The party found to have violated the company's trading protocol may lose part or all of the security deposit once a transaction goes into dispute and arbitration finds them as to blame. Such violations include the buyer failing to pay a seller, or a seller failing to acknowledge receipt of a buyer's payment. Part or all of the deposit will thus be awarded to the other party.

For Bitcoin payments, at least one confirmation is needed for the buyer to transfer fiat or the altcoin amount. The transaction also automatically goes into arbitration when a certain period occurs. For instance, that may be 6 days for Euro, 1 day for UK's faster payments and OKPAY and Perfect Money, or 4 days for US's Zelle and for global cash deposits and Western Union.

The minimum fee varies between 20 Satoshi/byte up to 400 Satoshi/byte. Head over to this page for details of fees and this page for a fee estimation service.

Coinffeine

Coinffeine is a decentralized peer-to-peer Bitcoin-fiat exchange platform based out of Spain and currently operates in 70 countries worldwide. With this platform, customers can exchange Bitcoin anonymously with strong security on the exchange without third party involvement unless under dispute.

Basically, users use a desktop application that resembles a traditional exchange. It is based on the game theory and features multi-sign transactions or micropayment channels. To mean, the conterparties or peers doing the transaction make a deposit with a small amount of bitcoins in a multi-sign transaction after which a time-locked refund transaction is created to ensure that funds can be recovered in case of failure.

After this, a micro-payment channel is created between the buyer and seller. On each round, a small amount of fiat is transferred using a payment process like OKPat and PayPal. The corresponding amount of Bitcoins is transferred through the channel. Anyone who does not transfer his/her part loses his/her deposit and that incentive makes the two to proceed with the exchange as needed. That settles the issues of trust as the algorithm serves as the escrow for the transaction. It verifies that both parties have submitted the funds and broadcasts the transaction.

Basically, sellers start by submitting their positions or asks (supply), to the order book. Buyers then set to fulfill these orders by placing bids (demand). The client software and P2P network then matches these bids and asks and uses the exchange algorithm to send and receive Bitcoins.

Although it is possible to transact anonymously since no account is required with the platform, users will need accounts with payment processors thus would submit their details.

With Coinffeine, takers pay the highest between Bitcoin fees and 1.5 percent of the order volume, while makers pay 1 percent of the volume of the order.

BitKan

China's BitKan is an iOS and Android app and web interface that allows users to trade Bitcoin with other people. The application displays traders in the user's area and their buy and sell quotes and users can then choose the person they want to trade with. They can then contact the person through the app and arrange a trade.

User safety is managed by way of traditional escrow where both users pay an amount which is locked until the transaction is complete. Besides, it provides price alerts and notifications and acts as a wallet where you can store, receive and send Bitcoins. You can also use it to monitor mining machine hash rates and set up an API for your mining pool to get notification about your mining pool and machine.

The users can create a trading account on the website or via the app and the account is approved before they can proceed with trades.

Paxful

Paxful works like LocalBitcoins where users can create or take an order to trade Bitcoins for fiat. Fiat is paid via a variety of payment methods including PayPal, Amazon Gift Card, Western Union, as well as Debit and Credit cards (more than 300 ways to pay for bitcoins). You do not even need an account with Paxful to buy Bitcoins because you can walk into a bank and pay cash to the teller. The system also uses a centralized escrow mechanism to hold the Bitcoins and these are controlled by the exchange moderators.

The platform now has traded more than 40,000 Bitcoins, and has 55,125 happy customers. It also works as a Bitcoin wallet. Selling Bitcoins involves topping your wallet with some Bitcoins, then head to the Sell page and select the payment method, and then create an offer from your dashboard with a price margin. The next process is accepting an incoming offer from a buyer. See more details on this here:

The company uses a muli-sig escrow system and verifies its sellers for the safety of its buyers. It also has a dispute mechanism in place.

Read more on Paxful fees here but the buyer does not pay.

Hodl Hodl

Hodl Hodl is a peer-to-peer platform that launched in February this year. It uses a multi-signature escrow system that also sets a predetermined trading time for both participants in the trade.

At the moment, they support BTC, and LTC and hopes to add more coins and features in the future.

Like LocalBitcoins and Bitquick, users do not have to verify their identities to trade, except that this would be needed when dealing with Moneygram, Skrill, various credit cards, Venmo, Western Union, Alipay, credit card and many more payment methods.

To sell BTC and LTC, a user fills trade requirements including the location, the amount they want to sell, a payment window, and the payment type. The seller deposits cryptocurrency into the multisig escrow address after creating the contract. The crypto is locked into an escrow until the buyer sends fiat. Buyers will then choose which trade seems appealing to them and can then proceed with buying.

They are currently waiving fees for traders (zero trading fees) until July 2018 but they will charge a maximum of 0.6 percent per trade when they come out of beta stage.

They also use a trader review and reputation system where the rating system is used for counterparties to trust each other to determine who to trade with.

BitQuick.co

BitQuick.co allows customers to buy and sell Bitcoins and charges a 2 % service fee and a 0.001 BTC mining fee for buyers but there is no fee for selling BTC.

The seller first creates a order by filling a sell form, after which they send the BTC to sell to their personalized escrow address provided on creating the order.

With BitQuick.co, buying involves selecting an order from the order book and paying the amount to the account using a specified method. The buyer then uploads the receipt and gets the coins within 3 hours of the seller confirming having received the fiat.

Apart from the above, there are many decentralized peer-2-peer exchanges that allow users to trade cryptocurrencies and altcoins directly on platforms without middlemen.

These include Altcoin.io which uses atomic swaps, Shapeshift.io, Changelly, Waves DEX, EtherDelta, IDEX, BitShares Asset Exchange and OpenLedger DEX, Counterparty DEX, CryptoBridge, Bisq, Oasis DEX, and AirSwap, Kyber Network and Bancor Protocol and Project 0x.