Atomicpay merchant payment solution to support 156 crypto-to-fiat options

Thailand-based payments solution provider Atomicpay is introducing a non-custodial digital currency payment terminal to allow users to convert more than 156 cryptocurrencies and tokens to fiat when making payments.

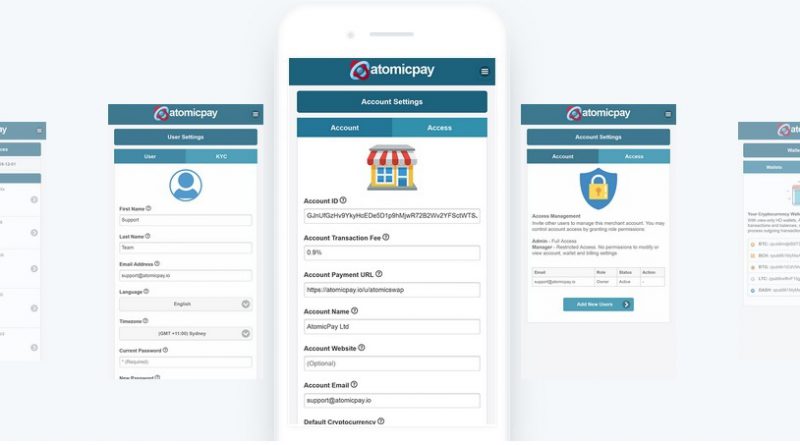

With this service, users will be able to make payments for as low as 0.8% per transaction when KYC is completed and 0.9% for non-KYC transactions. Additionally, merchants will have immediate access to their funds when they are paid by their customers using this service. This would make it much better than other digital payment services that hold funds such as Bitpay or Paypal. Clients or merchants can use the service to save 2 to 5 percent on each transaction paid via AtomicPay.

The peer-to-peer (P2P) payments solution will initially support payment in major cryptocurrencies such as bitcoin (BTC), bitcoin cash (BCH), litecoin (LTC) and others. Using the service means the customer will not need to use third-party services and gateways to do conversion or payments.

To accept payments from their customers, business or merchant will need to integrate AtomiPay into their businesses. To integrate their systems with the AtomicPay system, merchants can use QuickPay invoices, use custom plugs, embed PayButton/POS buttons on their websites, use PayURL unique short URL that is sent via email or SMS or messaging applications, or API that works with their existing systems. Customers are then directed to their payment page.

To facilitate payment, the service converts invoiced fiat amount into crypto using real-time exchange rate along with a pre-set time period for payment expiration. To make payments directly to merchants using the service, users will simply start by scanning a QR code or providing their crypto wallet address and then send the amount. The transaction takes place on a blockchain network and is validated within seconds. It also supports SegWit protocol to lower transaction fees and achieve faster transaction speed across supported blockchain networks.

The money sent goes directly to the merchant's wallet address. Merchants are charged on a post-paid charging model meaning they pay for the usage at the end of the month.

According to 1,700 merchants from countries such as Venezuela, Turkey, Thailand, and Colombia. However, the service can be used by merchants around the globe. Nevertheless, it is not a comprehensive solution since there is no wallet service and no exchange services when compared to platforms such as Waves. Currently, new merchants can sign up to benefits by processing up to $1000 USD worth of transactions at no charges.

The total transaction value for digital payments in Asia markets stands at $2,008,360m and is expected to grow at 16 percent to $3,673,258m by 2023.