This Week in Crypto

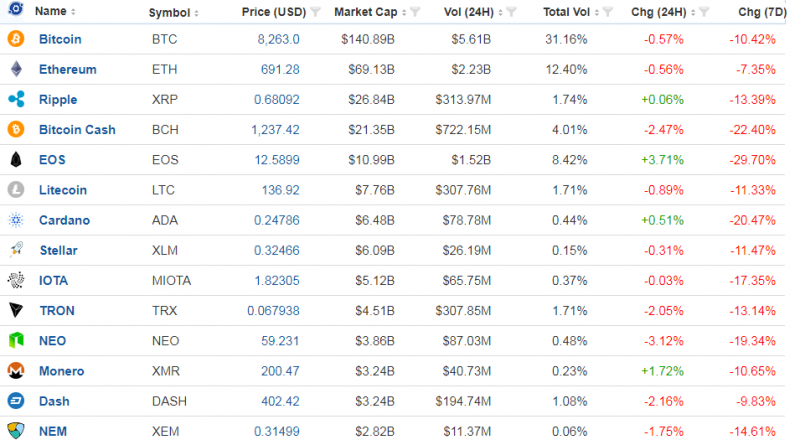

The total market capitalization is currently standing at $383 billion and the volume is $18 billion. That represents a loss of nearly $50 billion in market capitalization, to coincide with drops in price for most of the cryptocurrencies this week.

The volume dropped by around $1 billion in the week on average, although it spiked to a notable $29.9 billion last Friday and the lowest day level of $20 billion on Sunday. However, the volume is still higher by $4 billion from where it was this day last month although the highest recorded for the last 30 days was $37.7 billion on 25th April. It has been falling since then.

A month ago, the market cap was at $326 billion, when it generally started to improve to the highest hit of $467 billion on the 5th of May. It has generally been falling since then.

So far not so good for most cryptocurrencies in the last one week. All in the top ten have dropped on average with EOS loosing as much as 26 percent, Bitcoin as much as 10 percent and Ethereum as much as 6 percent. The falling trend was also notable during our weekly review last week.

Bitcoin dropped from $9367 last Thursday to the current price of $8323,which is not so bad a loss in an entire week in the face of volatility. In other words, you would have lost $1000 if you bought last Thursday and held in the week haul.

The price then fell to the week's lowest of $8247 on Saturday, and so the cryptocurrency remained confidently at the $8,000 level for the entire past seven days. The cryptocurrency is starting to recover today after a harsh week. Bitcoin still has proponents who feel that it will hit record high prices this year. One such is BitMEX Ceo Arthur Hayes who says the price will reach $50,000 price by the end of the year.

Ethereum was $763 on Thursday last week and is now trading at $706, which is also not a very bad show on a week haul for holders. The cryptocurrency hit the lowest of $665 on Saturday.

Ripple also started the week with $0.78 and is now $0.69. Ripple is still targeting to entrepreneurs and startup ventures to build partnerships and expand the XRP ecosystem, through the “Xpring” initiative announced on Monday this week. The fund will provide support to startups and projects that are using digital asset XRP and the open-source XRP Ledger.

The best performing cryptocurrency in the week was nowhere among the top tens. Zcash gained 23 percent in the week to $340, Augur gained 22 percent to reach $58.02, Decred gained 11 percent to $96.914.

For unpopular surges in prices, you would need to look for unpopular names such as Lightning Bitcoin that gained 71 percent in the week to reach $55.26, the APR Coin that gained by 130 percent to reach the current price of $4.03,or may be the TeslaCoilCoin that gained as much as 154 percent to reach $3.04, or perharps the WeAreSatoshi coin that gained by 311 percent to reach the current price of $0.016214, or may be the CyberCoin that gained by 89 percent to the current price of $0.029, or the XTD Coin that gained a 79 percent, or the W3Coin that gained by 102 percent.

There are others that recorded huge price surges, for instance the FuzeX that gained by 60 percent in the week, POLY AI by more than 58 percent, Vault Coin by 79 percent, GeyserCoin by 75 percent, JobsCoin by 79 percent. The list is endless for those that had a positive this week.

All in all, it doesn't have to be the top 10s but you get the idea why tracking the top tens is important: a drop for many in the top tens will almost translate to a drop in volume and market cap for the entire market.

ZCash started a run on Monday at the stare of Consensus Conference 2018 whose onset was expected to boost Bitcoin prices. Bitcoin recovered 4% from a three-week low on Monday and then 5 per cent in the 24 hours of starting of the conference, in response to the conference and has gained by around 10 percent today. But the price rise is still dwarfed by falls in the week on average. Around 8,500 people attended the just concluded conference, which is around three times last year's 2,700 attendees. Around 20 other events are scheduled around the event as part of the Blockchain Week New York that started last week Friday.

Announcements and news takes of the week

Coming fresh from the Consensus 2018 is the announcement by HTC that they will be launching Exodus – the world’s first blockchain-powered smartphone – with support for crypto such as Bitcoin and Ethereum. Everyone in crypto should love this because although one or two companies are working on blockchain phones, this is the first commitment from a notable phone company. Exodus will be based on a native blockchain network that support crypto trading between users.

Phil Chen, founder of HTC Vive and new “decentralised chief officer”, said.

“Through Exodus, we are excited to be supporting underlying protocols such as Bitcoin, Lightning Networks, Ethereum, Dfinity, and more. We would like to support the entire blockchain ecosystem, and in the next few months we’ll be announcing many more exciting partnerships together.”

Sirin Labs announced a blockchain phone late last year.

Jack Dorsey of Square and Twitter also said the same during the Consensus 2018 alluding to the fact that cryptocurrency could finally crown the internet world to make a perfect marriage. Those were not his own words but he said that Bitcoin will become the "native currency" for the internet.

"I'm just approaching with the principle that the Internet deserves a native currency," he said at the close of the Consensus Conference during Wednesday's fireside chat."It will have a native currency. I don't know if it will be bitcoin."

Elsewhere, the CEO of stock exchange Nasdaq Adena Friedman also said this week on CNN podcast Boss Files that cryptocurrency is the “right next step in the space of currency.” He alluded to the sentiments many in the crypto community have that cryptocurrencies could come on top as the preferred "globalized payment mechanism that is more efficient than what we have today allows for money to transfer across countries and certainly supports the internet economy."

And Facebook last week revealed plans for blockchain by launching a dedicated team, putting Coinbase board member David Marcus in charge of a new department looking at the technology. Marcus led the Messenger app for four years.

“Like many other companies Facebook is exploring ways to leverage the power of blockchain technology. This new small team will be exploring many different applications. We don’t have anything further to share.”

Still, there are more rumors this week that Facebook is getting more serious on the blockchain and is exploring the creation of its own cryptocurrency to let users make electronic payments. This is according to the news site Cheddar that cited people familiar with Facebook's plan, but again the news is not confirmed.

And even as crypto became more popular, a study conducted recently by a tech research firm MyBroadband and released this week, reveals that 47 per cent of the 1,244 respondents in South Africa plan to invest in cryptocurrencies, meaning almost half of country's citizens would if the population responds to the sample trend.

South Africa has been more welcoming for cryptocurrencies compared to many other countries in the continent. 25 percent said they will invest in cryptocurrencies, 15 percent in crypto and crypto mining and 7 percent in crypto mining alone.

Meanwhile, Ethereum held its Ethereum Ethereal Summit last week Friday and Saturday where different speakers, business owners and blockchain experts spoke of benefits of blockchain and how it an assist in decentralizing the society. Another notable conference Crypto Invest Summit 2018 in Los Angeles just concluded after attracting 4000 attendees.It featured 30 ICO presentations or panel discussions

For Bitcoin Cash lovers, the cryptocurrency is now listed on the Gemini Exchange as from Monday. Gemini is also set to be the first official Zcash trading platform after they announced that they will enable Zcash deposits beginning on May 19. The exchange will also be adding Litecoin.

Still on exchanges, the London Block Exchange (LBX), which has been listing only Bitcoin, Ethereum, Litecoin, Ripple, Ethereum Classic and Bitcoin Cash,is adding a bunch of new cryptocurrencies including Basic Attention Token, STATUS, Golem, OmiseGo and 0x. They are also launching a new Android app.

Coinbase is also adding four product lines according to a Tuesday announcement, in order to attract more institutional investors. These are Coinbase Custody, Coinbase Markets, The Coinbase Institutional Coverage Group, and Coinbase Prime. Coinbase Custody was launched in partnership with a SEC regulated broker-dealer to see the company securely store digital assets for clients. Coinbase Prime is a separate trading platform from both GDAX and Coinbase, which caters exclusively for institutions while providing them access to same liquidity pool. Coinbase Markets is an electronic market that will provide liquidity for all of company's products while Coinbase Institutional Coverage Group is a customer service dedicated to institutions. Coinbase said it hopes the new product line will pull in around $10 billion of institutional investor money sitting on the sideline.

For more blockchain optimism, HSBC Holdings Plc reported this week that it has completed the first customer transaction using blockchain. It is a milestone for the back that has been testing blockchain since 2016. The transaction saw the HSBC Holdings and (again) ING Bank NV handle a letter of credit for Cargill Inc., backing a delivery of soybeans to Malayasia. It was done using a one shared app rather than across multiple systems and could be the first scalable live trade finance transaction using blockchain.

The transaction would have taken five to ten days to complete under traditional systems but took less than 24 hours under the system.

The letters of credit used during the transaction are one of the most widely used methods of reducing risks by importers and exporters. They help guarantee more than $2 trillion worth of transactions but create large amounts of paperwork in the process under the traditional systems.

Other news is that China Electronic Information Industry Development (CCID) of the Ministry of Industry and Information Technology, which is a major department of the Chinese government, is launching a crypto index that will feature an independent monthly analysis of cryptocurrencies and public blockchain technology.

Global Public Chain Assessment Index will provide a guide for governments, enterprise companies and research institutes. It could mark China's shift in treatment of blockchain and crypto in future.

The index will feature 28 cryptocurrencies including Ark, Bitcoin, Bitcoin Cash, BitShares, ByteCoin, Cardano, Dash, Decred, Ethereum, Ethereum Classic, Hcash, IOTA, Komodo, Lisk, Litecoin, Monero, NANO, NEM, NEO, QTUM, Ripple, Siacoin, Steem, Stellar, Stratis, Verge, Waves and Zcash.

Bad news from Bing and Alibaba

Unfortunately for this week, Bing is blocking cryptocurrency advertisements starting June. The advertiser policy manager Melissa Alsoszatai-Petheo said on the Bing Ads blog that the reason is because "cryptocurrency and related products are not regulated"and therefore" present a possible elevated risk" to their users "with the potential for bad actors to participate in predatory behaviors, or otherwise scam consumers.” Thus the move is to help protect their users. The ban affects any "advertising for cryptocurrency, cryptocurrency related products, and un-regulated binary options.”

Bing follows announcement by Google, Facebook and Twitter who banned these types of ads a few months ago.

And E-Commerce giant Alibaba's Jack Ma has also said during the 2nd World Intelligence Conference in Tianjin that blockchain is not a bubble but Bitcoin is, even as PayPal CFO John Rainey said its merchants were reporting low interest for cryptocurrencies due to their high volatility hurting merchant businesses and thus the company will proceed cautiously on the issue of supporting cryptocurrencies. He said PayPal would "certainly" support cryptocurrencies if they were more stable in future.