Surveys: Crypto and blockchain gaining more popularity

Grayscale: more than one-third of Americans would consider buying Bitcoins

Grayscale did a survey of 1,100 Americans between the ages of 25 and 64 and the results indicated 36% or 21 million investors in the U.S. would consider investing in Bitcoin or are interested in buying but are being held back by concerns such as the threat of hacking and lack of regulation. Seventy-five percent of all investors and sixty-eight percent of those who are interested in investing in Bitcoin.

Grayscale Investments is a global leader in digital currency asset management and did the research in association with a market research firm known as Q8 Research.

According to Grayscale, most of those interested in bitcoin, or about 70%, are parents and nearly half make less than $100,000 per year. This category is also more experienced and risk-tolerant than average investors. What makes bitcoin appealing to them is that they can invest small amounts in bitcoin in addition to the fact that there is growth potential and due to the scarcity (limited supply of 21 million units) of bitcoin, which are other appealing factors for bitcoin to investors.

Grayscale said their research indicates that even a small allocation to crypto can increase the overall performance of an investor's portfolio by only “modestly increasing” risk. Grayscale said that over the period from Sept. 25, 2013, to June 30, 2019, adding just 5% in bitcoin to a simulated global 60% stock and 40% bond portfolio more than doubled cumulative returns from 41.9% to 90.9%.

The survey points to a few of some of the challenges such as security and unclear regulation as well as their impacts on the adoption of crypto. Currently, a total of nearly $1.39 billion has been stolen in the crypto industry through hacking, according to research by Block. In terms of regulatory clarity, the United States Senate Banking Committee is set to hold a hearing on crypto and blockchain regulatory framework on July 30, even as U.S. Treasury Secretary Steven Mnuchin recently yesterday said in an interview on CNBC’s Squawk Box that the future of cryptocurrency was bleak.

“I would bet even in five to six years I won’t even be talking about bitcoin as Treasury Secretary,” He said. His comments are not unusual since he previously said that cryptocurrencies posed a risk to the financial system if misused like Swiss bank accounts. He wants Financial Crimes Enforcement Network (FinCEN) and the Financial Action Task Force (FATF) to come with guidelines that hold cryptocurrencies to highest standards.

He has also previously erroneously claimed that fiat is not used as vehicles for money laundering and that there are billions of dollars of transactions going in bitcoin and other cryptos are used for illicit purposes.

Kaspersky: 19% of people globally have purchased cryptocurrency; 11% of Americans own Bitcoins

In June, Cybersecurity firm Kaspersky had also released a survey carried out October and November 2018 and involving 13,434 respondents in 22 countries. The survey released on June 17th indicated that 19% of people globally have purchased cryptocurrency. 81% of global population have never purchased cryptocurrencies and only 10% of respondents said they “fully understand how cryptocurrencies work. 14% of those who have never used crypto said in the survey that they would like to do so in the future.

As indicated in yet another spring survey, 11% of the American population owns Bitcoin with the largest percentage of the owners being in the age category of 18-34 years. 89% of U.S. citizens have heard about crypto regardless of their generation. Also, based on a report from another different survey carried out at the same time, 3% of American retirees own bitcoin.

Bankrate survey: 9% of millennials prefer crypto as top long-term investment option

9% of millenials chose crypto astheir long-term investment option, which is nearly three times the percentage among earlier generations.

Earlier on, a survey released by Business Insider on July 5 indicated that only 6% of Generation Z, defined as those born after 1997, would be somewhat, very or extremely likely to buy cryptocurrency in the next 6 months.

According to the Bankrate survey, cryptocurrencies are the seventh most popular investment option among Americans with 4% of respondents choosing crypto as their top choice for a minimum 10 year investment/ The 4% was lower than 5% of the respondents who chose "none" in response to a list of assets they would choose to invest their cash in the long term.

Real estate, stocks, cash investments (savings accts/CDs), gold/metals, bonds, are the top five most popular investment options for Americans.

CivicScience: U.S. citizens do not trust Libra as much as bitcoin

Just 2 percent of people surveyed by CivicScience would trust Libra and its Calibra wallet more than bitcoin. By comparison, 40% of respondents said they trusted bitcoin more than Libra while 19% said they would trust both options about the same.

According to CivicScience, only less than 10% of those surveyed had actually bought cryptocurrencies.

77% of those surveyed said they did not trust Facebook with their personal data at all. Just 2% said they did. This is given the previous poor track record of Facebook with related issues such as with the Cambridge Analytica scandals. 86 percent of respondents said they were not interested in Facebook’s crypto and wallet project: only 5% said they did.

Out of the overall 5% of those interested in Libra project, the largest group was mostly those aged between 18-24 (30%) and this group also polled as having more experience with mobile payment apps such as Venmo and Apple Pay. 18 percent of those aged 25-29 formed part of the overall 5% interested in the project but only 7% of those aged 65-plus had any interest in Libra.

CivicScience said more research was needed to understand the high levels of mistrust towards the Facebook crypto adding that this was similar to the trend when bitcoin surfaced more than 10 years ago.

CivicScience survey of more than 2,100 U.S. adults in July showed 79 percent have heard of bitcoin or other cryptocurrencies but only 6% of the respondents were invested in crypto, half liking the experience. However, most of the survey respondents were not holding any crypto, using it and are not planning to.

Ernest and Young: 68% of businesses in Asia-Pacific region don't understand blockchain

Lack of confidence in and lack of understanding of blockchain is affecting adoption of the tech in Asia-Pacific region according to a survey by Ernest and Young.

The survey results showed that 66% of respondent think they would need a more robust understanding of how blockchain can benefit their organizations as well as the involved risks before they can consider implementing it.

According to the survey, this lack of understanding in blockchain and its benefit is is also manifested in the two major misconceptions about blockchain as held by many respondents. 46% of participants believe that blockchain “is a trust-less system and does not require a central authority,” a fact that does not hold true for permissioned blockchain although it is true for public blockchains.

The second misconception is that of security where 43% of participants held the view that “blockchain is not as ‘unhackable’ as they say it is. While there are many reported hacks, in many cases its vulnerabilities on the applications built on top of the blockchain.

Nevertheless, a recent survey by Stack Overflow showed 20% of organizations are using blockchain and the confidence in the tech was improving, with 67.6% of respondents saying they believe the technology is useful. IHS Markit has also predicted the blockchain market to be worth $2 trillion by 2030.

NTT survey: blockchain, AI, IoT will have greatest impacts on financial services and trends, execs say

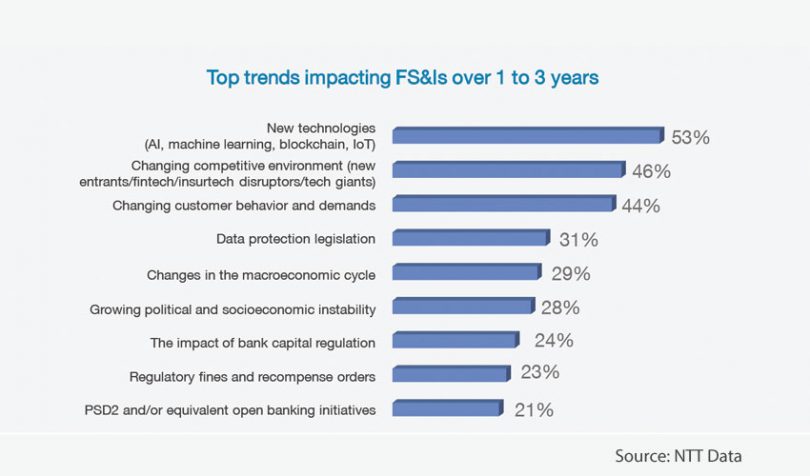

Most of financial services and company executives believe that blockchain, AI, machine learning and IoT will be number one techs in influencing trends in financial services in the future. This is according to a recent survey by NTT Data.

Out of the 471 companies surveyed by the organization, 53% hold this opinion. Changing competitive environment will be number two to influence trends in financial services sector, having polled support from 46% of the respondents, even as many financial executives see and anticipate new entrants from both fintech startups and technology giants to influence the space. To that effect, 83% believe that new entrants could become significant competitors.

About competition, 65% of respondents see Amazon as the biggest threat in all regions apart from Japan. That's compared to Apple, Alibaba, Walmart, Facebook and Tencent. Respondents in the survey came from U.S., U.K., Germany, Spain, Italy and Japan. The surveyed execs were decision-makers, influencers or aware of budgets for Digital Business Platforms. So they may be biased towards tech.

According to the survey, 78% said the list of financial services leaders will be very different within five years. 9 out 10 said now is the time for transformational digital change compared to 7% who viewed, 3 years ago, fintech as a threat and 15% planned to invest in modernization efforts.

Further, 61% of financial services companies are dopting new business models in response to a combination of new technologies, competitive threats and customer demand. These models are being deployed within Digital Business Platforms (DBP) owned by existing tech giants. DBPs can allow financial services companies to deploy new business models without gutting existing legacy systems. Additionally, 84% of financial services firms are envision partnering with fintechs and insurtechs while 66% imagine using fintechs, insurtechs and the platforms of large tech players like Amazon for purposes of distribution.