Where to Trade Crypto on Leverage/Margins: Over 20 Best Places

Leverage or margin trading is now popular on most of the main cryptocurrency exchanges and also on the major licensed broker trading platforms. For a start, you can read an introductory article about leverage and margin trading to understand what it is and how it is done.

Right now, if you are looking to trade cryptocurrencies on leverage, you can opt to trade in raw crypto or CFDs.

We found some of the best dedicated cryptocurrency exchanges offering crypto leverage/margin trading as Kraken, Poloniex, Huobi Pro, OKEx, CEX.io, Bitfinex, Coinexx, all of which currently given from 2x to 500x (2 times to 500 times) in leverage. Even so, the most normal leverage range for all of these exchanges is 5x to 20x, with Bithumb Global set to launch full features later this year with 100x leverage, Coinexx already offering 500x leverage, and Binance yet to launch the feature but having confirmed that they will.

If you are looking for some of the best features for leverage trading, plus if you want generally more leverage or multipliers, then cryptocurrency CFD contracts may be a better option for you. At WhaleClub, AvaTrade, Plus500, RoboForex (50x) and Evolve.Markets (50x), where leverages range from 10x to 50x or at Deribit (100x), XENA (100x), BitMex (100x), PrimeXBT (100x) and ADS Prime (500x), where leverages are in another entirely different level, you can access this sort of option.

Otherwise, below is a more detailed review of some of the main exchanges and broker trading platforms where you can trade different types of crypto either as real crypto or as CFDs on leverage.

Kraken

Kraken, which serves customers in now over 190 countries, also has margin and futures trading. Overall, it provides leverage trading for up to 5 times or 5x of your margin. Like BitMex and PrimeXBT or other similar exchanges, you can long or short trade your positions, allowing you exposure whichever the direction the involved prices are going. On Kraken, leveraging allows you to short cryptocurrency through the leveraging trading feature. This is due to the fact that leverage is generally not supported in spot trading (normal no-leverage trading). More specifically, on the Kraken platform, leverage may only be selected using the Intermediate and Advanced order forms. Beginner accounts won't be able to do so.

Again, not all pairs are supported for leverage trading and you can confirm the margin trading pairs from this link on their exchange. Basically, Kraken supports leverage for Augur, Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Monero, Ripple, and Tether allowing for over 22 pairs for margin trading.

Qualified traders can borrow up to $500,000 for the purpose of leveraged trading and traders never pay more than 0.02% (per 4 hours) in rollover fees. Like any other crypto exchange or trading platform with this feature (except PrimeXBT), you are not able to withdraw the funds or spend them for trading until the position tied to the margin is closed. During trading on leverage, the profits or loses are unrealized until you close the account, when the balances are adjusted.

For Kraken's leverage trading, the cryptocurrency in which you are holding collateral does not need to match the margin pair you are planning to trade in. You can hold collateral in a variety of cryptocurrencies (Bitcoin, Ethereum, Euro, US Dollar, Canadian Dollar, and Japanese Yen) and still trade a different one. With this, however, it's important to note that you cannot exchange that amount into another cryptocurrency while the position remains open.

Furthermore, Kraken puts limits on margin or leverage trading that are known as margin borrow limits. This means that the limit in question depends on a trader's verification level (Starter, Intermediate, and Pro) and the cryptocurrency involved. A table on this link lists all of the relevant margin borrow limits.

For example, for XBT or Bitcoin, those with Starter accounts can borrow up to 2.5 BTC, while Intermediate level users can get up to 25 Bitcoin and Pro level users can get up to 250. To create a leverage order position, visit the New Order Tab, right from the dashboard, then select "Intermediate" or "Pro," and indicate the level of leverage (2, 3, 4, or 5). Following this, fill out the type of currency, whether you want to establish a buy (when going long) or sell position (shorting), then denote the amount to trade and the order type. When willing to trade on leverage, selecting a level of leverage (2, 3, 4, or 5) creates an order to open a position and with a single margin order, you can create multiple trade positions depending on how many trades are used to fill the order. You can then track your order position where all of your current trade positions are listed.

In this case, these limits also apply to the cryptocurrency you are borrowing. If, for example, you're borrowing USD in order to buy BTC, then limits apply to the USD involved. If you're shorting BTC, i.e. selling it, then the limits will apply to BTC because you need to borrow BTC in that case.

The amount required to open a leverage position, called the initial margin, depends on the leverage level. If you choose to amplify trades by 5x for instance, the margin required is higher than when a leverage of x2 is applied. At a 3:1 leverage, the initial margin is a third of your value of the position (meaning you need to deposit only a third of the value of the total cost of what you are buying or selling), while at 2:1 leverage, the needed collateral is only half of the total value.

You do not have to use all your trade balance for collateral trading, so the rest is known as free margin, which you can then spend as collateral to open other positions simultaneously with the rest of your existing positions.

Kraken also allows traders to flip positions or change from long to short or short to long positions at any time, which is done by simply opening an opposing order with more trade volume than your open positions for the pair in question. For instance, if you already have two short positions each open at 1 XBT volume, you can close the two by opening an another position to buy 3 XBT at 3:1 leverage, especially if you wish to end up going long 1 XBT at 3:1 leverage. The final position is then considered "long" for the amount equal to balance of the two trades, i.e., 1 XBT.

In leveraging, orders are executed or open positions closed on a First In First Out (FIFO) basis, meaning the ones you opened first will close first before subsequent ones; but it is still possible to use the closing order tool at the bottom of the open positions list in order to create a new limit order.

Once this is done, you can then choose to close all open positions currently running (if the tool is set with 100% volume), or half of them (if the volume is set at 50%), or even a quarter of them (if set at 25%). In addition to all of this, you can even create a limit order that will close all positions and create an opposing position of the same volume if set at 200%. Therefore, in the latter case (200%), you end up flipping the position from long to short or vice versa which then lets you close as many positions as you want with a single subsequent order/position.

As an alternative to this somewhat convoluted process, there is also a settle order tool allows you to create a settle order that would settle all positions (if set at 100% or 200%), half of them (set at 50%), or a quarter of them (25%).

What this means is you can close an entire long position by creating a leveraged sell order with an equal amount to the order you want to close. This means you can close half or a lower percentage of the long position by creating a leveraged sell order that uses a part of the amount in the previous position to carry itself out. You can also close a shorter position entirely by creating a leveraged buy order with an amount that is equal to the existing short position. Alternatively, you can also set "0" as the volume on a closing leveraged order to close all open positions with just one order or to close the small remaining volumes of open positions.

Trading on leverage at Kraken is charged a normal trade fee (this ranges from 0% to 0.26% of the total trade value and depends on the trading pair or pairs involved), among other factors. These include the trader's 30-day trading volume and whether the trader is a maker or taker in a certain trade), plus the margin fees that were applied (margin opening fees and margin roll over fees), which depend on the total value of the order and are charged in the borrowed currency that it was purchased with. For instance XBT (Bitcoin) leverage trades attract 0.01% for an opening fee and 0.01% (per every four hours) for a roll over fee that is charged to maintain a position for some specific period of time, say a day or more. For BCH, you pay 0.02% and 0.02% for these particular fees (per 4 hours).

Poloniex

Poloniex was the only exchange launched in 2014, which makes it one of the oldest in the market. It was later acquired by Circle, which is a Goldman-Sachs backed company. When a trader places a margin order with Poloniex, the amount loaned for leverage trading is taken from other users who are offering their funds as peer-to-peer loans through the "lending" account feature, while the balance of the trader who is borrowing is used as collateral for the loan. Allowed leverage goes up to 2.5x. Some of the cryptocurrencies available for margin trading include Ether, Ethereum Classic, Dash, Dogecoin, Litecoin, Monero and Stellar, all with Bitcoin as their base pair.

Like others in this list, Poloniex allows long and short position trading on margins. The trader/user is required to retain a margin collateral at the rate of 2.5 times the leverage in order to keep their margin trading positions open. Otherwise, their positions get liquidated if they fall below the Maintenance Margin level.

Poloniex divides the number of accounts into three types: exchange, margin, and lending, with the exchange account holding funds meant for regular trading (known as spot trading) and margin accounts holding collateral used to secure loans and to settle debts when a user engages in margin trading, while lending accounts are used to hold funds that can be lent others in exchange for a commission.

Funds can also be sent from the exchange to outside margin and lending accounts. You then can place a buy or sell order with leverage at this point. To do so, from the buy/sell menu, you set the price of the crypto and the amount of it you want to borrow, followed by the "loan rate", which is a feature that allows a trader to set the amount of maximum daily interest he or she is willing to pay/take (in the case of sell orders) for an order, if it has loan on it. You then place the order.

Once the order is placed, loans are offered at the best available rates even if a trader specifies a higher "loan rate". If no loaner/lender is offering loans at that specified rate, then a trigger order will be placed instead of a margin order. That means you can set a value, but that can also adjust upwards or downwards based on, for instance, the length of time you leave a trade position open.

All in all, what a trigger order does is track available rates so that when an loan order is placed, the trigger order will grab it and place your margin order at your set value. If your loan expires after more than two days, it is then transferred to new lenders at the best available rate. Trigger orders and stop limit orders can still fill at a lesser amount if market conditions change, provided that you previously specified said amount.

“Tradable balance” is the actual amount of money you have for trading in the margin account. The tradable balance depends on the market conditions, open positions and account balances, and other factors.

On the dashboard, users are able to track their margin trading accounts from the right side of the margin trading page, beneath the markets box. Each user account gives an overview of its' current total margin value (the total BTC value of all the currencies in your margin account), the tracked, unrealized profits or losses from the current open positions, the current level of initial margin or the current margin needed as collateral to borrow a given amount of crypto, up-to-date tracked, unrealized lending fees from open positions, and the total borrowed value (amount of BTC you are currently borrowing plus the amount of BTC that would be needed to buy on the current order books). From the same feature above, a user can also track their current margin and maintenance percentages in order to know their applicable level of maintenance margin and therefore, estimate the amount of remaining maintenance margin that should/shouldn't sustain their open trading positions.

A forced liquidation will take place automatically if the current margin percentage falls below the required maintenance margin, which is why these indicators are essential to follow. This is done using one or more market orders, meaning the liquidity of the current market can affect your losses that are garnered from the applicable liquidation exercises.

When a trader tracks their current margin effectively, he or she can take necessary measures such as reducing open positions to keep their positions from being liquidated and reducing the size of their open positions to reduce risk and so that the current margin can remain above the maintenance margin. Otherwise, it would still be possible to keep adding more collateral to sustain open positions instead of reducing their size.

Before doing any of this, it's important to remember that Current Margin is calculated as the Net Value over the Total Borrowed Value and may be used to identify when the market is moving against your bets, which can tell you when to close or adjust positions and avoid further losses. Of course, you'll know automatically when the market is moving against your bet without having to watch this feature by just looking at price movements.

For those interested in monitoring these margin figures, if the price of a borrowed currency decreases while on a long position, the amount of the loss, together with the relevant lending fee are added together. Then, the total of this subtracted from your margin account's balance.

If the balance now falls below the (borrowed amount x maintenance margin percentage), liquidation occurs. A forced liquidation happens when the system prevents q loss by closing all or some of the trader's open trading positions to prevent a situation where the trader would default on their loans. In this case, remember that you can still transfer funds from your exchange account to your margin account before that happens.

Poloniex has a peer-to-peer lending feature that allows people to offer loans to others for trading in leverages. Those who lend out Bitcoins or other cryptos receive interest on these loans, while those who receive the loans have to pay said interest. This interest is governed by a specific contract and since the loan is used by other lenders for margin trading, it is paid directly to your lending account when this contract ends after the deduction of a 15% fee that goes to Poloniex.

The peer-to-peer lending feature also allows a trader to lend out money on an auto-renew basis that can be stopped at any time. During this time, the trader involved is able to see all of their active loans that they have given, including when they opened and how long they run for. Users can also choose to store funds in USDT if they have a fear of market volatility, but they will need to withdraw coins into a separate platform to make any sort of exchanges to fiat. Deposits are also only allowed for regular crypto trading.

ForexClub

Forex Club, by Indication Investments Limited, offers trading of stocks, cryptocurrencies, forex, metals, indices, agriculture, oil, gas, and ETFs, even on leverage. For crypto, traders can currently access more than 50 pairs with additional ones on the way.

Known as Libertex, it was founded in 1997 and is an international brand with over 20 years of experience in financial markets and online trading. It now offers 213 tradable assets overall, with 2.2 million clients coming from 110 countries globally, and physical operations in 27 countries.

The platform, which is certified by the Financial Commission, was named the Best Trading Application and Best Crypto Currencies' Broker of 2018, along with other related awards in 2017 and 2016.

For retail clients, ForexClub offers up to 30x leverage, though professional forex traders can increase this to up to 600x.

Leverage trading is allowed, though allowed leverage levels differ, depending on the account type , for cryptocurrency trading. These usually amount to 2 times for retail accounts and up to 20 times for professional accounts. Traders qualify for a professional account by sustaining a sufficient level of trading activity for 12 months (have performed an average of at least 10 transactions per quarter and these trades should be of a consistently significant size). The trader should also have relevant experience in the financial services sector and have a current financial instrument portfolio of over €500,000.

For those trading on margin/leverage, fees apply as one-off entry costs in opening a CFD. There are also ongoing costs (daily swap costs) which increase as the duration of holding a position increases, and rollover costs, that are applied when rolling over a contract into the next month or quarter, which is equal to the spread to open and close a trade.

There are no spreads for bids and asks.

RoboForex

RoboForex is the Belize-based unit of the Retail FX brokerage group, which allows traders to trade Bitcoin, Bitcoin Cash, Dash, EOS, LiteCoin, Ripple, Ethereum, Bitcoin Gold, Golem, IOTA, Monero, NEO, OmiseGO, and QTIM, and other cryptocurrencies, starting with as low as $10 with an average leverage of up to 50x (for RoboForex Ltd).

Customers are able to use MetaTrader5 and 4, as well as R Trader on the platform to trade cryptoassets and open a range of accounts. These conditions of these accounts differ based on leverage, max order volume or slots, max step volume, and spread. For instance, the Pro Standard account offers a max leverage of 2000, a 0.01 - 100 order volume range, no limit on the number of positions a crypto trader can open, up to 10% on account balance, free withdrawals of funds, and 1.3 spread points and above.

All crypto trading pairs have a minimum order size of 0.001 and a max of 100 for their base currencies in addition to a step volume of 0.001, but the ticksize varies from one pair to another as per this link.

The platform offers cashback for trading volume of just 10 lots in addition to up to a 50% profit share bonus up to 20,000 USD, and a 50% profit sharing affiliate program.

Trading commission is 0.3% (minimum fee is 0.01 USD), while the financing fee for leverages is -20%. Stop Out level is 20%, which is the margin required to be maintained in this case.

Again, there is an option for a demo account before beginning live trading.

BitMex

BitMex allows traders up to 100x of leverage on some of its products. BitMex offers prediction contracts each one of which is paid in Bitcoin. Like on many exchanges that allow for margin trading, the trader will need to keep some balance as collateral to leveraged amount, which is refunded if the position closes in profits, otherwise it can be lost even at a certain position (if risk is too high) before the trade is carried out. This is known as liquidation.

For BitMex, the actual leveraged amount depends on the initial margin deposited, which is the quantity of Bitcoin that they must deposit before they can open a leverage position. The amount leveraged also depends on the maintenance margin, defined as the quantity of BTC the trader requires to hold in their account to keep the trading position open. The trader loses leverage and the order is closed if the maintenance margin is not maintained.

In other words, if a trader is unable to maintain the maintenance requirement, their position will be liquidated and the maintenance margin is therefore lost. The maintenance requirements are determined on the basis of risk limits because as traders amass larger leverage or margin positions, the risk increases. That means risk increases as the amount leveraged increases. As the market moves against their bet, and they lose value of equity, the trader poses a risk to other traders who may experience deleveraging if the position cannot be liquidated by the time the mark price reaches the bankruptcy price ( price at which a traders’ positions are closed out) and that deleveraging is automatic to any opposing traders. In this case, those deleveraged have their open orders canceled and they can re-enter new orders. For deleveraging, priority is given to more profitable and higher leveraged traders, which means they are deleveraged first.

To avoid the issue of a trader posing a deleveraging risk to other traders, the system imposes higher margin requirements for large positions through a step model. These risk limits are meant to minimize occurence of large liquidations on margined contracts. A trader will need to authorize a higher or lower risk limit on the "Positions" panel which means the margin requirements will automatically increase and decrease as the trader's risk limit changes.The risk limits vary from crypto to another according to the table on this page.

For instance, for BCH/XBT futures contract settling on the BBCHXBT30M Index where the price of each contract is equal to its price in Bitcoin, the base risk limit is 50 XBT and the step is 50 XBT which means the risk starts at 50 XBT and increases or decreases in steps of 50 XBT. The maintenance margin for the contract is 2.50% and the base initial margin is 5%.

A trader who wishes to trade on leverage on BitMex has two options: going long or short where going long means opening a position in believe that the price will increase and shorting means selling a contract in anticipation for a price decline with an option of buying it back when prices are lower and thus making profit as the price difference after returning the advanced amount.

Leveraging is done on the account from the "Trade" tab on the trader's dashboard. A user selects the crypto they wish to trade, the type of order they wish to place, the amount they wish to trade in US Dollars, and then the trader can set a level of margin they desire for their open position using a slider in the order box. The use is presented with details such as “Quantity,” which is the trader's position including the leverage (the risked amount should be less than what is shown in the “Quantity” field); "Cost," which is the amount the trader would lose if the market goes against their prediction; and the “Order Value,” meaning the trader's position in Bitcoin. The trader can then select “Buy Market” to take a long position or “Sell Market” to short the crypto.

BitMex leverage trading can be somehow challenging for new traders, but luckily, there are free demo accounts with which they can first test their trading strategies without adding any risk or funds. Lastly, the cryptocurrency exchange has detailed guide on how to do trading and leveraging.

PrimeXBT

Seychelles-based PrimeXBT allows users to trade cryptocurrencies, Stock indexes, Commodities and Forex with a single Bitcoin-based platform and at 100x leverage on BTC, ETH, LTC and other cryptocurrencies. Like in the case of BitMex, traders are able to choose to go short or long on their positions, and trade with 5 order types.

Like in the case of other markets, PrimeXBT allows traders to take advantage of small price movements through leverage, meaning you can earn lots of profits even as the profit changes by a small percentage. However, the risk of losing also increases with increase in leverage.

Like the case of BitMex, a user will deposit some margin, which means putting a fraction of the full value of the trade in order to qualify for a leverage position. The leverage amount also depends on the various margin requirements imposed on different types of trading pairs. For instance, one can get a leverage of 1:100 when looking for an exposure from 0-10 BTC and is required to maintain 1% of value as collateral.

The margin requirement changes to 2% for an exposure of from 10-15 BTC and the leverage in this case is 1:50. For more than 15BTC, one is required to keep 10% as margin requirement and gets a leverage of 1:10. These margin requirements and fees change from crypto to crypto and are indicated in this link. Of course, if a trader opens a position, they have to ensure that the margin is maintained to point the position closes. Otherwise, if the trader is unable to maintain the margin required as the trading progresses and market changes, and the price movement against their bet leads to exhausting of their equity such that the value in the account falls below margin (a certain level), they won't "Margin Call" you to ask for the margin like is the case with traditional financial brokers, but the system will instead close out the position in order to manage the risk on their books.

However, PrimXBT offers portfolio margin which means a trader does not need to add margin to open a new trading position if they are already making profit in an existing continuing and unclosed trading position. That's because they can use the unrealized profit on a continuing unclosed trade as margin to open a new position. Also, unrealized profit on one position may be used to offset any unrealized losses on the other, meaning if you have an existing trade position that has registered some profit, it can be used to offset losses on another trade position. This is targeted to active traders who may be trading multiple assets at the same time since they can effectively use capital without having to close profitable trading positions.

For long leverage positions, the profit is equal to the difference between the closing price and the opening price multiplied by the amount of assets bought. The margin is applied on total order value at purchase. For instance, a trader is willing to enter a long position when Ethereum is $314.7 by buying 200 ETH expecting the price to go up. The value or position of the trade is $62940 and the trader will not need to pay the full amount when buying because PrimeXBT offers a leverage: the trader needs to cover only 10% of leverage or $6294 for them to buy. If the price goes up and the trader decides to close their position when ETH is $354.2, their profit is 354.2-314.7 = 39.5 multiplied by 200 ETH. Another trader willing to short Bitcoins at $7,400 for a total short position of $74,000 in value (meaning they are selling 10 Bitcoins). With a margin requirement of 1% for 10 BTC, the trader will need to deposit just $740 as collateral and if the price drops, to $7,354, they will buy back 10 BTC at $7,354 meaning they take a profit of 7,400-7,354=46 multiplied by 10 BTC.

To understand the amount of leverage you would qualify for, the exchange provides a Leverage calculator. Based on the calculator, the amount you qualify for in leverage depends on the capital they have. For instance, one can qualify for a leverage of $1000 with a capital of $10.

In terms of fees, the cryptocurrency charges trade fee and overnight financing for leverage trading. The latter depends on the liquidity of the underlying asset and is (overnight financing) not charged if the trader opens and closes a leveraged position within the same trading day. While the trading fee is constant at 0.05%, the financing/day long and financing/day short will depend on the type of cryptocurrency. For instance, for Bitcoin, financing/day long costs -$20.1 per 1 BTC and financing/day short -$10.3 per 1 BTC. For Eth, the two are -$1.63 per 1 ETH and -$0.84 per 1 ETH respectively; and for XRP, -$0.00178 per 1 XRP and -$0.00098 per 1 XRP respectively.

Besides the fees and margin requirements, there are exposure limits, which you cannot exceed for a particular position. As may already have been said about risk in leverage trading, the risk management department sets an exposure limit for a trader based on a number of factors including the instrument liquidity, volatility and other market conditions and a trader cannot place an order that exceeds the limit. The limit also varies from pair to pair according to this link. For instance, for BTC/USD pairs, the minimum order size is 0.01 BTC, minimum order size change is 0.01 BTC, maximum single trade size is 60 BTC and the maximum exposure is 60 BTC. These are maximum leverage limits and one can opt for lower number level especially so because even a slight amount of volatility can lead to an exhaustion of funds with 100x leverage.

AvaTrade

AvaTrade is a licensed trading broker similar to eToro, and not only allows customers to trade individual cryptocurrencies but also crypto CFDs such as Bitcoin and Ethereum CFDs. Leveraged trading of cryptocurrencies at AvaTrade allows the user/trader/customer to gain benefits regardless of the direction the price is headed, meaning you are able to short and long trade. The platform allows up to 20x leverage for crypto trading.

AvaTrade allows trading of Bitcoin, Ethereum, Bitcoin Cash, Bitcoin Gold, Ripple and Litecoin for BTCUSD, BTCEUR, BTCJPY, BCHUSD, ETHEREUM, XRP(RIPPLE), LITECOIN Mini, BTGUSD, EOSUSD and trading is 24/7 on MetaTrader accounts. You can trade these crypto against different fiat currencies such as USD, EUR, JPY etc.

AvaTrade has cryptocurrencies trading as an additional product to others such as forex, stock, ETFs, indices, CFDs, commodities, bonds and treasuries, and therefore, like eToro, they are great for customers who want to trade all those assets on a single platform while spreading risks.

For crypto traders, like most of other broker trading platforms, AvaTrade also allows the use of automated trading software called Expert Advisors to create automatic orders and submit them to the exchange. These bots can perform repititive work several times and at very high speed. Trading crypto on this platform also allows position copying or trade mirroring of experienced traders.

Traders also benefit from multiple analytical tools, indicators and charts.

For those interested in finding margin requirements before kicking off trading, The requirements can change to increase during times of volatility, but presently, trading crypto on leverage requires a trader to maintain a margin of 50% for MetaTrader 4 and AvaOptions accounts, and the equity/balance on the account must be 50% above Used Margin for all open positions, otherwise, the broker will shut down the client's positions and keep shuting until the equity is above 50% of this used margin in equity. That's because of the need to manage risks when the market is moving against the trader's bets.

On AvaOptions accounts, all the client's positions will be closed when equity falls below used margin, while on MetaTrader, the largest positions are closed first and others are continually shut until the equity returns to 50% of used margin. There is also imposed a maximum position for each of the crypto pairs tradable at AvaTrade, and this varies with pairs. For BTC pairs, the limit is $600 k, Eth pairs $400 k, XRP pairs $250 k, BCH and LTC $200 k, BTGUSD and EOSUSD $50K, and Palladium $400K. These can also be reduced during times of volatility.

Regarding losing one's position, it is still possible to use different order types such as Stop losses to manage those risks and keep them down. Other order types include Take Profit, Buy Stops and Buy Limits with the last two being upcoming order types.

Regarding fees charged for leverage trading, AvaTrade charges spreads as well as overnight interest (long trade being held overnight and the maximum is $5 per one standard lot), while other fees such as maturation rollover and corporate actions may apply, and all inactive accounts will attract an inactivity fee. The spreads are volatile and will depend on market conditions.

Another advantage with AvaTrade is that you can run a demo trade.

Huobi Pro

Huobi Pro offers up to 3x margins for both long and short positions. Margin trading at Huobi Pro attracts a daily interest rate of 0.1% for every 24 hours (or less when you trade leverage for less than a day), this being the interest you will be paying when trading leverages.

Buyers are required to use leverage multipliers reasonably and to control their trade positions with different order types in order to reduce the risk rate of margin trading, because although it can be used to amplify profits, it can also lead to amplified losses even to negative balances within no time and subsequent closer of the positions. In addition to using the relevant risk management order types, a trader can close positions spontaneously to keep loses within reasonable range if the market is moving against their bet. Otherwise, it is possible to keep positions open for as long as you wish for as long as you can add margin in time to maintain a wallet margin balance of over 110% before the current balance reduces to unacceptable level when the system would close a position and liquidate automatically by the system.

The amount to be loaned also depends on a crypto pair.

In order to open leverage trading on Huobi Pro, users require to run a Margin Account which is separate from the Exchange Account. There is no direct transfer of funds to a Margin Account: all funds must be transferred from an exchange account to margin account. Therefore, you need to run two of these. You can operate a margin account for a pair, and this account will hold each of the crypto in the said pair that can be traded on leverage, say ETH/BTC Margin Account to keep ETH and BTC crypto, and even transfer each of the crypto in the pairs, say ETH and BTC, from the Exchange Account to the opened Margin Account for the pair. A margin account can loan any crypto in the pair (BTC and ETH in this case) ETH/BTC account .

Margins are applied as loans from the Margin Accounts using the Margin Management feature. The amount to be loaned depends on user's maintenance margin and leverage times choosen and users are able to loan up to 2 times amount of the maintenance amount. Risk Rate = (Wallet Balance/Loaned Amount x 100%).

Users are able to repay loans in parts but in that case, their interest must be paid first.

Plus500

Plus500 is a licensed broker platform that works like the already popular eToro, allowing trading of CFD instruments on shares, indices, options, ETFs, forex, commodities and cryptocurrencies. For those customers interested in crypto CFD trading on Plus500, the world's most popular cryptocurrencies are available for trading: Bitcoin, Ethereum, Bitcoin, Ethereum, Litecoin, NEO, Ripple XRP, IOTA, Monero, Stellar, EOS, Bitcoin Cash ABC, Cardano, and Tron.

Plus500 also supports different order types you can use to manage risks when trading in leverage: these include stop limit, stop loss, trailing stop, guaranteed stop, negative balance protection, free email and push notifications on market events, alerts on price movements, change % and traders sentiments.

Otherwise, like other similar trading platforms and cryptocurrency exchanges offering margin trading, trading positions are closed whenever equity falls below the maintenance margin amount. This means since the price doesn't have to or may move against your bet, it means keeping your trading position open for longer makes things worse during this time and your equity or balance will continue to fall as the price moves against your bet. If you are unable to close the position, most crypto leverage trading systems will force a liquidation in order to reduce risks on their end because in some cases a price movement would leads to exhausting of your equity when the trade position is finally closed and making a negative balance. That means if you do not come back to fund the account, it would mean a loss on their end.

Thus customers are required to monitor their open trade positions at all times and ensure that they have sufficient funds on their account or take a decision to close any or all of their open positions. It would be not prudent to watch a trade exhaust the balance when the price movement is not favorable.

For cryptocurrency traders/lovers who are willing to start off trading crypto, one is able to start trading with a demo account. For live trading or real trading, the leverage varies from one crypto CFD instrument to another. For instance, for Ethereum, the leverage would be 1:15 or 15 times, Bitcoin 1:10, Litecoin 1:10, NEO 1:10, and Ripple 1:10.

For those trading these CFD instruments, it is possible to manage risk in a number of ways, for instance by using trailing stop orders and positions, limit and stop loss orders. Close at Profit works like a Take Profit order which enables one to protect profits while the Close at Loss works like a Stop Loss to limit loss if the movement is against odds or against your bets. The Guaranteed Stop will put a limit on your potential loss. The position is closed at a specified price without any risk of Slippage.

In regard to trading fees for leverage trading, the broker platform charges fees in the form of spreads and overnight funding fees and both of these fee types vary from one crypto CFD instrument to another. For instance, for Ethereum, the spread is 1.45 or 0.60% and overnight funding buy fee/charge is -0.06072% and overnight funding sell charge/fee is -0.02148%. A trader has to have an initial margin of 6.67% in order to access leverage trading while the Maintenance Margin is 3.33%. That means one must keep equity of 3.33% of the leveraged or loaned amount to maintain an open trading position.

For Bitcoin, the Initial Margin is 10% and maintenance margin is 5%. The spread for Bitcoin is 45.01 or 0.56%, Overnight Funding - Buy is -0.06072% and Overnight Funding - Sell is -0.02148%.

You can check details regarding margin, spreads, overnight charges for all crypto pairs via this link. Otherwise, the overnight daily funding is calculated as Trade Size * Opening Rate * Daily Overnight Funding %. Otherwise, there is no deposit fee, no roll over fees, no fees for opening or closing trades, no fees for live sharing of CFD prices, no fees for real-time forex quotes, and there is no fee/charges for using dynamic charts and graphs.

Guaranteed Stop Orders however, will attract some additional fees in form of wider spreads because they come with guaranteed stop loss and your position gets closed at a specified requested rate. There is also an inactivity fee of $10 for inactivity for three months.

Deribit

Deribit is a Bitcoin Futures and Options Trading platform in the category of BitMex and PrimeBTX in terms of the amount of leveraging allowed, because it allows a leverage of up to 100x.

To qualify for an account type (called Portfolio Margin account and which are available upon requests) that allows one to trade in margins/leverage, a trader will need to maintain a minimum of net equity of 0.5 BTC or 15 ETH and they need to have some experience in trading options and declare to understand the concept of portfolio margin trading.

To award the account to a trader, Deribit has certain portfolio margin qualifications, which are carried out based on a risk-assessment model that determines margin requirements for leverages based on historical volatility of a crypto and by valuing a specific portfolio over a range of underlying price and volatility moves. The risk-based approach considers positions in futures and options combined, which may help to reduce the margin requirement of a given portfolio. Thus traders with these kinds of Portfolio Margin accounts, can get access to increased leveraging and lower margin requirements.

For such an account, a trader will also be required to keep an initial Maintenance Margin of +30%. You can refer to further parameters used in determining maintenance margin for a Portfolio Margin account on this link, alongside examples that can help you understand the parameters.

As you will find in the above link, other parameters used include the maximum implied volatility change of (30/days to expiration^0.30*18.00%), the contingency component of 0.01 BTC per option for all net short options per strike, the contingency component of 1.00% of the underlying value that is added for offsetting futures, and contingency component of 0.00% for VEGA’s offsetting in different expirations.

There will be no initial margin required for open orders. However, individual limits to the amount of open orders allowed exist per account, although one can send an email to an exchange admin if interested in having more orders opened than risk management currently allows.

eToro

eToro allows the margin trading of crypto contracts both on short and long positions. From the "trade feature," a trader will select the asset they want to margin trade, then select either Sell (short) or Buy (long) tab depending on the direction they think prices are headed. The trader is able to then select the amount of capital they wish to invest in the trade position and the leverage multiplier, which depends on the asset selected for trading. He or she can then select the Stop Loss and Take Profit parameters where a Stop Loss is the limit for that trading position which will mitigate the possible risk to the capital involved. After this, the order can be placed.

Remember eToro is a broker trading platform that allows the trading of cryptos as CFDs, meaning the contract involved lets the user bet on price movements, while never owning the actual crypto being used to do so. Even so, it is still possible to trade, deposit, and withdraw individual cryptos with eToro. For CFD contracts, however, there are no deposits and no withdrawals, as well as no risks relating to the management of the cryptos used, as mentioned above.

On eToro, 31 pairs, including those of main top crypto assets, are available for CFD leverage trading. For leverage trading, including for countries operating under CySec or FSA regulations, all non-leveraged long (Buy) crypto positions are opened with underlying assets or real crypto while leveraged and short positions are opened as CFDs. For clients residing in countries that operate under ASIC regulations, all positions are opened as CFDs. Therefore, on eToro, a trader can deposit real crypto assets to open long positions but leverages only apply to CFDs.

EToro does not charge any deposit or trading fees but applies spreads which vary from one crypto to another according to this link. For instance, for Bitcoin is 0.75 % and BCH is 1.90%. There is also $25 fee for withdrawals. There are also overnight/weekend fees for CFD positions. Overnight fees vary from crypto to another and depending on whether you are selling or buying, with the BTC overnight fee being -2.200689 per BTC for selling and -2.200689 per BTC for buying.

The fee shown on the above link do not apply to long non-leveraged positions when individuals are buying or selling individual cryptos (non-CFD contracts). They apply to leveraged BUY positions, as well as to all SELL positions, and to all crypto pair positions.

OKEx

The Malta-based, OKEx crypto exchange, recently increased its' trading leverage from 3x to 5x for Bitcoin, Ethereum, Bitcoin Cash, Litecoin and EOS. The exchange now offers margin trading for BTC/USDT, ETH/USDT, ETH/BTC, LTC/USDT, LTC/BTC, ETC/USDT, ETC/BTC, EOS/USDT, and EOS/BTC.

Eight days ago, OKEx also announced an increase in the margin borrow limits of up to 500% for the spot trading pairs of ETH, BCH, LTC, ETC, BSV, and NEO.

OKEx allows traders to long and short positions via margin or to arbitrage or hedge exposure in combination with futures or perpetual swap trading. From the "Token Trading" feature, a user is able to transfer their crypto funds/balance from the spot account to margin account, then click on "5X Leverage" tag on the pair available for leverage trading, in order to borrow limit of 0-4x in order to trade with up to 5x their capital.

For each pair supported, there is the denominator being the base token which the trader is to sell and the numerator the quote token or the token to buy. For instance, a BTC/USDT pair means a trader will borrow BTC to short BTC or borrow USDT to buy BTC. When a user borrows USDT to buy BTC, they can then open a position to sell BTC when its price increases and then repay the loan in USDT to keep the remaining profit.

Of course, USDT price remains constant. In order to short BTC, a borrower borrows BTC and sells it for USDT. When the price drops, they buy back BTC to repay the loan principal and interest and retain profit. Repayment must be made in the token borrowed and the interest is incurred daily and payable at any time. The interest rate is locked for the first 24 hours after successful borrowing and is updated every 24 hours based on demand and supply of the token and must be repaid every 7 days.

Once a customer opens a position, there still is the requirement to keep their equity above a certain level, otherwise forced liquidation may kick in if margin held cannot sustain the loss. Customers can either stop loss or add more collateral. A gaining position can also be closed any time via take profit order.

If forced liquidation occurs, the trader will still, after repaying all the debts, incur 10% on his remaining assets as liquidation fees, which is injected into the margin trading insurance fund used to cover market loss of bankruptcy positions.

OKEx uses a risk management system when assessing the leverage and maintenance margins to allow for higher trading volumes.

They also recently introduced Tiered Maintenance Margin Ratio System on Futures Trading in order to avoid cascade liquidation of orders and to allow for minimizing the risk of clawback. Currently, the exchange liquidates all open positions if a user cannot keep equity above required risk margins. The system is called full liquidation and will soon be replaced by the tiered one where open positions will not need to be liquidated all like is currently with full liquidation.

The Full Liquidation feature offers two leverage levels to users: 10x and 20x, and when the user's margin ratio breaches 10% or 20% (for 10x and 20x leverage), a margin call will be triggered and all the positions will be fully liquidated. In cross-margin mode, all of user's open positions are canceled and position force-liquidated if futures account equity is =10% of his margin for 10x leverage (=maintenance margin ratio =10%) or =20% of his margin for 20x leverage (=maintenance margin ratio =20%).

In fixed margin mode, which is incoming, only the positions of the liquidation side will be closed when forced-liquidation is triggered (when the same conditions for 10x and 20x as explained above are met). Unlike with the exchange's existing full liquidation system that offers 10 or 20x leverage and where positions are fully liquidated when margin call occurs and where margin call for all positions are the same, the new partial 1-100 x leverage liquidates positions partially when margin call occurs and the larger the positions are held, the higher Maintenance Margin Ratio will be required and the lower the leverage will be available. For Futures Margin Trading, the new system awards higher effective leverages of 1-100 x for BTC, 1-50x for EOS, ETH, LTC, BCH; 1-30 x for ETC, XRP; and 1-20x for BSV and TRX.

A Maintenance Margin Ratio is the lowest required Margin Ratio to maintain the current trading position open. As mentioned before, the tiered system was adopted to avoid liquidation of large positions which causes big impact on market liquidity. The Maintenance Margin Ratio increases with the increase in positions held and this means lesser leverage is available for a trader with more positions. For BTC contracts, tiered Maintenance Margin Ratio means tier 1 has a Maintenance Margin of 0.50% and leverage of 1-100x, tier 2 1% and 1-5x leverage, etc according tothis link.

In regard to fees charged for leveraged amounts, or the daily interest fees, you can refer this link. Basically, they vary from crypto to crypto with BTC at 0.02%; ETH, QTUM, XRP, EOS, DASH, TRX, BCH and LTC at 0.01%; ETC at 0.02%; NEO 0.033%; USDT 0.0425%; and BSV 0.0113%. The maximum amount to be loaned as leverage also differs from crypto to crypto and all are quoted in USDT with BTC for instance leading at 2m USDT, ETH 1.5 m etc etc according to the table in the previous link.

XENA

London-based XENA offers XENA Perpetuals, which are cryptocurrency-settled derivative contracts that are intended to mirror spot prices of underlying assets or indexes. Perpetuals are like futures in that they are agreements to buy an asset at a pre-determined price. However, unlike futures, they do not expire and are viewed as better hedging opportunities against a price drop.

On this exchange, you can trade Bitcoin, GRAM, Bitcoin volatility, mining difficulty and other underlying assets. Besides, you can trade to short or long a position, and therefore benefit whichever direction the crypto or asset market is moving. XENA then offers 100x leverage for each of the perpetual contracts traded on the platform.

If one fails to maintain the required equity level to keep the risk manageable when the market is moving against their bet, for each open position, the price movement is confirmed before the position is liquidated. Bear in mind that a trader can use the Price Range, Upper and Lower Limits, Stop Loss, Trailing Stop Loss, Fire or Kill, and Attempt Zero Loss types of orders to protect their positions against unexpected price swings in the market and to manage risks.

XENA unrealized profits/losses are settled to the traders' account each hour meaning they can then use the earnings (in case the market movement is favoring their bet meaning they are making some profit) immediately without closing their positions or paying fees and spread. So you are able to keep the position open and can recover the profits already acquired for other things.

The Perpetual Contracts available currently for leverage trading are XBT/USD and XGRAM, which became available to public on March 12. Gram is the Telegram token. For Xena, it is an opportunity for those who did not invest in Telegram ICO to be able to earn dividends on potential rate hikes through trading perpetuals on the exchange. This will also allow current holders to hedge against possible exchange-rate drops. The cryptocurrency exchange hopes to offer settlements in fiat later on for the perpetuals instead of BTC, when volatility of BTC/fiat reduces.

For those who are trading contracts on margin/leverages, XENA charges maker and taker fee for margin trading depending on tiers that vary with monthly turnover for the perpetual; with tier 0 (monthly turn over of 0 BTC) attracting -0.025% in maker fee and 0.075% in taker fee. Tier 1 (> 10000 BTC) attracts -0.025% in maker fee and 0.073% in taker fee; while tier 2 (> 50000 BTC) attracts -0.025% in maker and 0.07% in taker fee. Additionally, there is no deposit fee but withdrawal fee is charged based on the crypto in question.

Besides margin trading, XENA allows traders to trade crypto in the spot markets for taker's fee starting as low as 0.05% and maker's fee starting for as low as 0% depending on the trading volume, meaning the more you trade the less you are charged.

Bitfinex

Bitfinex allows traders to trade at up to 3.3x leverage for cryptocurrencies like Bitcoin, Ethereum, EOS, Litecoin, Ripple, NEO, Monero and many more. The exchange facilitates margin trading for both short and long positions, meaning you can lend to buy and then sell when prices go north or still lend to sell at current prices, if you're expecting a drop. In other words, almost any sort of action is possible in this case.

Bitfinex's leverage is offered through their peer-to-peer funding market and there are a suit of order types that a trader can use to take advantage of every situation. These orders include: One Cancels Other (OCO), Post Only, Hidden Order, Limit Order, Market Order Stop, Trailing Stop and Fill or Kill.

To leverage, a user can enter an order and borrow the desired amounts for a desired duration or open a position and the system will lend at the best available market rates at that time. The amount of financing, the terms, and the applicable interest rates are negotiated through the Financing Order Book between Financing Providers and Financing Recipients on the platform.

The peer-to-peer feature is a feature that allows users to lend out their cryptocurrency and earn interest, and those amounts are then lent out to traders who are interested in trading with leverage on the exchange. This feature then comes with other sub-features such as auto-renew to allow the automatic renewal of the loan upon expiry.

For margin trading fees, Bitfinex charges 15% of the fees generated by active margin funding contracts (collected by Margin Funding Providers). This charge rises to 18% of those fees when the contracts are opened by a hidden offer. That means fees are deducted from those providing funding, while those leveraging would be expected to pay normal trading fees as applied elsewhere.

CEX.io

CEX.io offers leverage of up to 10x for ETH and BTC. Remember, it is a cryptocurrency trading exchange featuring a variety of order types, technical analysis instruments and advanced trading tools.

CEX applies different leverage ratios and fees for different pairs; there is an open fee and rollover fee applicable to each pair. Also, each pair qualifying for leverage has different leverage ratios.

For instance, the BTC/USD pair attracts different leverages 1:2, 1:3, 1:5, 1:10 or up to 10x like is the case with all the other pairs (BTC/EUR, ETH/USD, ETH/EUR, and ETH/BTC). with open fee for the BTC/USD and other pairs being constant at 0.2% for all pairs and also roll over fee being constant at 0.01% per 4 hours for all the pairs. The exchange does not charge any deposit or withdrawal fees for those trading on leverage/margin.

One more thing about this crypto exchange is that you are able to try a demo account for free before live trading.

Coinbase Pro

Coinbase Pro is targeting its services to institutional and professional investors and offers a variety of cryptocurrency trading options including Bitcoin, Ethereum, and other major cryptocurrencies over popular fiat currencies like the USD, GBP and EUR. It is insured by the New York Stock Exchange, Andreessen Horowitz, and Union Square Ventures, as well as other investors.

The platform, which is available in 32 countries, offers, among other features, margin trading with a leverage of up to 3x on BTC/USD and ETH/USD pairs, a limit of $10,000 or 2x for BTC/EUR pairs and a limit of up to 3,000 EUR, among other features.

Their product was built around the Commodity Exchange Act. Since it is an institutional-focused cryptocurrency exchange, the requirements for qualifying as a margin trader include being a corporation with a net worth exceeding $1,000,000 and trading on margin in order to hedge risks associated with your business. Individuals need to have a minimum of $5,000,000 invested on a discretionary basis in order to be allowed to trade on margin.

Coinexx

Coinexx is a platform for forex and crypto trading which also allows deposit in 25 altcoins, in addition to the top coins. It allows a leverage of up to 500x for crypto traders and it is possible to trade from 0.01 micro lot on the platform. On this page, you can find out the exact amount of margin you require as collateral to trade a given trade size for a particular crypto trading instrument (BCC/USD, XRP/USD, LTC/USD, ETH/USD, BTC/USD pairs) depending on the leverage you require (up to 500x). Coinexx customers use MT4 and MT5 platforms.

Besides, the tight spreads applied on leverage trading, and which you can track for various crypto instrument pairs on this link, Coinexx also applies swap charges/fee deducted when an investor keeps an open position after 00:00 server time (GMT+3) according to whether position is long or short. These charges are calculated based on the interest rate differential between two currencies pairs, whether it is a long or short trade.

For this swap, interest is earned on purchased currency and paid on all currency sold. The system will debit or credit accounts for the positions held after 00.00 server time, which is based on your time zone. These swap charges are calculated weekly on the basis of interest rate differentials, market conditions and risk management analysis. You can also calculate your applicable swap charges based on the trading instrument in question, trade size and number of days you keep the position open plus other factors as is in this link.

Like many other platforms listed here, you can also operate a demo account before live trading.

HYCM

Like eToro and AvaTrade, HYCM (previously known as HY Markets) broker trading platform allows trading of close to 100 financial instruments on commodities, indices, stock, forex, precious metals, binaries trading through the HY Options, and currencies as well as cryptocurrencies in CFDs.

This broker platform, which has been in operation since 1977, offers Bitcoin, Ethereum, Ripple and Litecoin contracts as well as over 110 other assets on the Prime, Hycm mobile, and MetaTrader4 platforms. All of these contracts expire each month.

Traders can access a leverage of up to 1:10 or 10x for all five supported cryptocurrencies.

A trader will required to deposit a minimum of $100 in order to start trading on the platform whether on leverage or not.

Trading crypto on this platform will attract commissions and spreads and these spread rates range from 1% to 4% depending on the crypto in question, as per the 2018 contract schedule here.

Overnight swap rates are 20% for all products with both long and short positions.

ADS Prime (ADSS)

ADS Prime is now known as ADSS and allows the trading of Bitcoin, Ethereum, Ripple, Litecoin and Bitcoin Cash in CFDs either on long or short. One CFD is equal to one unit of your chosen cryptocurrency. It uses the ADSS MT4 and the OREX trading platforms.

With regards to leverage trading, you are able to get up to 500x leverage, alongside flexible lot sizes including mini, micro and standard lots. You also get advanced charting and analysis with over 50 indicators on the MT4 and EA builders, with the added capability of being able to build your own indicators. When trading crypto, prices are provided by the platform's liquidity provider ADSS Securities LLC, which sources its' price information from multiple exchanges.

Regarding conditions of trading crypto on this platform, it has its' own internal market risk limits and this means it can apply “Closing Only” designations to manage risks for open positions, which means new cryptocurrency CFD positions cannot be opened and existing positions can only be maintained or closed.

You can also open demo accounts to practice trading or test your trading strategies.

Evolve.Markets

Evolve.Markets is an online Bitcoin broker on which a trader can deposit Bitcoin or Litecoin to trade in cryptocurrencies, FX, and other CFDs with the Metatrader5 tool (trading can be done on web, desktop and mobile platforms). Currently, it offers pairs such as: BTC/USD, LTC/USD, XRP/USD, DSH/USD. BTC/EUR, ETH/USD, EOS/USD, XMR/USD, BCH/USD, ZEC/USD, ETC/USD, and XTZ/USD, all of which can be traded on short and long positions.

Evolve Market currently gives a traders a leverage of up to 500x on forex and up to 50x when trading cryptocurrencies.

Some of the features available for accounts that are trading in cryptocurrencies include Orderbook Trade Matching, 24/7 trading, and market analysis.

The required margin or collateral in USD for 1 lot in each crypto pair will differ from one crypto pair to another, as will the swap rates (short and long swap rates charged for maintaining an open trading position for a day or more).

For instance, for a BTC/USD pair, one would require a maintenance margin of $154.77 or 0.01999995 for 1 lot size which has a minimum volume of 0.01 BTC and point size of 0.01 BTC.

Whaleclub

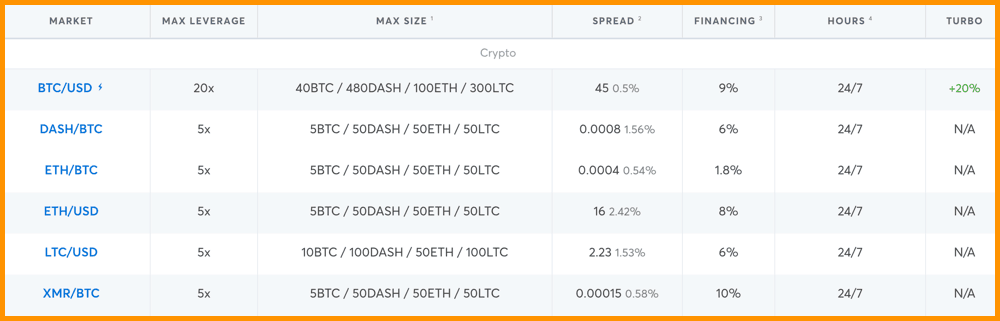

WhaleClub is based in Hong Kong, has been operational since 2016, and allows the margin trading of cryptocurrencies, commodities and forex. In the case of cryptos, this means that margin trading is supported for BTC, LTC, ETH, XMR, and DASH. For each of these cryptocurrency pairs, there is a different max of leverage. For instance, for BTC/USD, it's 20x, while for Dash/BTC, ETH/USD, ETH/BTC, LTC/USD, and XMR/BTC, the maximum leverage is 5x.

Whaleclub does not charge any fees for deposits, balances, executions and inactivity, but there is a withdrawal fee which is 0.001BTC and a leverage fee for the exchange to provide leverage that is available 24/7.

Deposits are acceptable in BTC and DASH only.

However, their fee is based on spread only model financing fees that are applied on an hourly basis based on the size of the trader's position, multiplied by the market daily rate and divided by 24. All spreads and financing fees vary from crypto pair to another according to this table below.

Bithumb

South Korean cryptocurrency Bithumb recently opened a new service called Bithumb Global, which includes perpetual futures trading that can be done with leverage up to 100x. The service was launched earlier this week and therefore, is new and in beta testing, meaning it is accessible to trade with test money. All the features will be available when the feature goes live.

The exchange was already offering Bitcoin perpetual futures trading before launching the new service and thus, it is expected to offer leverage trading for this platform as well. In the future, the new platform might support crypto futures trading too, but as of yet, that is not as clear.

This new service, called Bithumb Global, was launched as Bithumb announced a push to expand internationally, with additional fiat-crypto trading pairs alongside their perpetual futures trading.

Binance

Binance has not launched margin trading yet, but its' CEO Changpeng “CZ” Zhao has confirmed that they will be launching the feature in the future.