Points is combining blockchain and AI to help the unbanked

Points or PTS blockchain-powered startup is using AI, big data and blockchain to help bank the unbanked who due to one reason or another cannot access banking services in the traditional settings. For instance, for a person that wants a loan from legacy banks, you would need a rigorous and comprehensive credit check.

People with little or no history of banking would not qualify and sometimes have to wait for some times before they can qualify.

A lot more people would qualify for some money in loan but may be not that much to advance their goals, whether they are individuals or companies.

That's where, in many cases, those startups targeting to offer these services fit best because legacy banks also operate in strict conditions and may not be able to on-board these types of clients. But let's face it: tech development isn't segregated and no matter what sweet promises a single type would offer, there is going to be better versions. So how will, beyond cryptocurrencies and blockchain, AI, other types of advanced DLTs, and Internet of Things combined save "our" industries?

Back to the financial sector, blockchain and cryptocurrencies tech has so far attracted a host of startups hoping to seal holes in the legacy financial sector in interesting ways, from loan services to cross-border transactions. An example of a fintech hoping to help bank the unbanked is Singapore-based Points, which is using a more relaxed way of accessing customers' credit checks: it uses big data and AI to calculate the score based on someone's bill payments, shopping activities and individual's occupation.

It also uses data from Zhong Cheng Xin Credit Technology, China’s first nationwide credit rating agency. The credit agency is one of the many partners who seed funded for PTS: others are Danhua Capital, Ceyuan Ventures and the Ontology Foundation. With this credit rating application partnership, the firm can also draw data about customers from legacy banks and financial institutions.

The company is also partnering with Teleinfo, a subsidiary of China’s Ministry of Industry and Information Technology in order to do KYC for customers by getting data about them. Another example is Helicap, which also will be providing the same services.

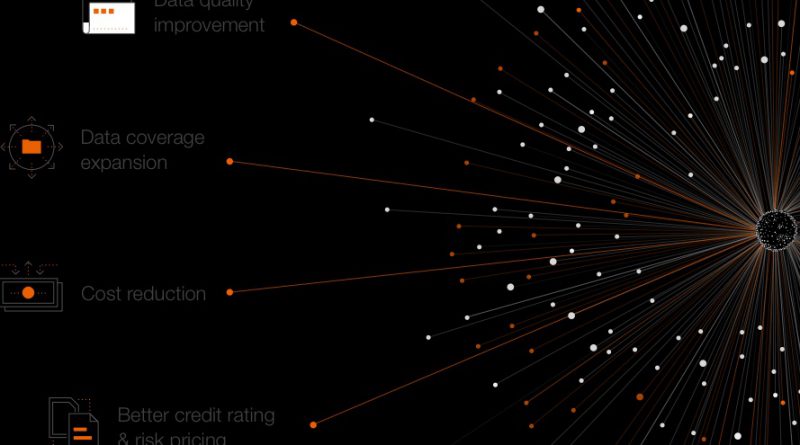

Points views unlocking of the current pain points in the data marketplace as important in unlocking potential in the credit markets. For instance, some of these challenges include lost trust by customers with financial institutions that also lack incentives to share credit related data with each other.

Legacy systems also tend to not involve non-financial institutions such as e-commerce and social networks in data contributions yet are important channels in the society, and the lack of effective channels for individuals to contribute owned data to the credit system. The blockchain-based system hopes to solve the problem of overlapping data and the fact that AI is not being fully exploited to optimize the data system. The startup has so far collected 500,000,000 credit profiles and supports 10 k transactions per second.

Points uses Ontology public blockchain to calculate the score. A customer submits their data on this platform and it will calculate their credit score to accept or deny their application. Their protocol avoids storage of data during the on-boarding and the company, this way, avoids breaches that could happen during the process. Co-founder Sarah Zhang told Techinasia news outlet that data management is one of their main challenges for instance securing the data.

According to the former chair for Beijing-based blockchain talent platform dCamp, chief operating officer and senior director of Segway Robotics, senior product manager at Amazon and growth hacker at Draper University which are all companies/organizations she previously worked with. They receive 80 kinds of variables from 500 million customers, which means it is a lot of data. Securing it on blockchain ensures it is safe. They are also partnering with Oasis Labs to research further on secure computation.

The system can not only secure data, but also helps to decipher what happens in case their is data breach.

Moving on, PTS is also using Coinsta, a cryptocurrency ecosystem application and digital management tool that helps make wealth management services accessible to users from all income levels. Customers who pass the KYC can participate in the crypto or token system by earning PTS tokens by choosing to contributing their personal data to the digital identity management database.

Those who receive the tokens are then able to exchange the tokens for coupons and other perks. Besides this, they will be establishing partnerships such as with lending firms to bring onboard more users and data. Coinsta is only their first of applications they intend to build on the PTS protocol. They also intend to partner with more consumer-facing apps that can use the protocol.

Other applications of their protocol beyond consumer lending and credit profiling include ABS and investment, insurance and healthcare.

Is it ok to clear up some misconceptions? This is a great post nonetheless, so kudos!