DEX: Decentralized Exchanges will Solve Problems with Centralized Exchanges

Decentralized exchanges (DEXs) on the blockchain can remove risks eminent in centralized exchanges where the user needs to first trust the assets to a third party. For instance, although many centralized exchanges are appropriately guarded, some have been hacked or compromised in the recent past, making many users lose their assets.

Besides the internal and external risks eminent in a centralized exchange platform, transactions on centralized platforms are non-reversible and transfers are hard to trace.

These problems are largely dealt with by decentralized exchanges.

To strike the difference, a user in a centralized exchange will deposit funds and then the exchange service issues an IOU ((I Owe You) tokens) that are freely traded on the platform. A user can withdraw funds but the funds are converted back into the cryptocurrency they represent and sent to the owner.

A decentralized exchange is a trustless system that does not involve a third party holding customer's funds. An automated process ensures that the trades occur directly between users or through a peer-to-peer automated method or process. User's funds are held in the personal wallet and not held with an exchange, hence could be safer.

Even in the event of an attack, the extent of damage is limited in a decentralized platform. A decentralized system achieves more privacy because users do not disclose personal information to third parties except the revealing of identity to the person you are trading with if the exchange method involves bank transfers. The exchange is also distributed through nodes, meaning the risk of server downtime is reduced.

However, for fully functional decentralized exchanges to work, there has to be a very high blockchain transactions throughput. This is while it would be possible to put all trading data on the blockchain, one must deal with blockchain latency and tons of data which you have to synchronize over all the nodes.

Many decentralized systems try to solve that by doing blockchain settlement on the blockchain but doing the order matching in a centralized manner.

In other words, the server that matches incoming orders cannot access the funds. The transfer of funds on the blockchain is achieved only when the server finds a matching pair. Orders must be matched correctly in order for the transfer to happen, and this is verified in a decentralized way. Centralized systems achieve a high execution speed and thus can be beneficial in providing “matching as a service” in these systems.

There are various solutions being designed to facilitate decentralized exchanges.

- Use of proxy tokens: In this case, crypto assets that represent a certain fiat or cryptocurrency or assets are created.

- Use of assets that can represent shares in a company

- Use of decentralized multi-signature escrow system - This system helps with trust such that the asset is held in a system until the other user pays. - Fully functional smart contracts

However, unlike centralized exchanges, decentralized models do not currently have a number of features including margin trading, lending and stop loss.

Categories of decentralized exchange platforms

Decentralized exchanges can be categorized largely as those that handle native fiat and those that handle pure digital tokens. They can also be categorized into those that allow for single blockchain token trading and those that allow for cross blockchain trading or atomic swaps.

Waves and Bitshares are examples of cryptocurrency exchanges that have a DEX or decentralized exchange built into their products, but the DEX uses external gateways that transfer assets on the blockchain into real world currencies.

Bitsquare

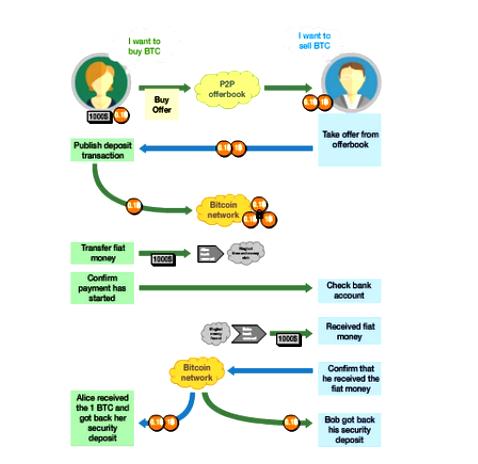

Bitsquare, which is an open-source project, uses a decentralized multi-signature escrow system for honesty of trades and the buyer and seller can trade directly (peer to peer) without a third party or middleman.

With Bitsquare, users can buy and sell Bitcoin for cryptocurrencies and national currencies (USD and EUR). Users view, publish and accept trade offers for Bitcoin through the Desktop application. The offers are submitted to a public offer book and all communications are exchanged through a custom P2P network over Tor.

The multisig escrow system works by the user depositing a security deposit that is refunded after the trade is complete. Also planned was a decentralized arbitration system planned for purposes of solving disputes -- it introduces a third key holder with a key in the 2 of 3 multisig escrow address but is only needed when something goes wrong.

Bitshares and Openledger

Bitshares allows people to trade the platforms own crytpocurrency or BTS, Market Pegged Assets (a crypto asset pegged to another currency and whose value is backed by the bitshares currency and can be converted back at any time) and User Issued Assets (issued by anyone to represent).

OpenLedger is Bitshare's web-based version of Bitshares that runs on the underlying blockchain.

Bitshares allow the trading of Dollar, Euro, bitcoin, gold, and other cryptocurrencies and assets that must be backed by reserves.

NXT

NXT allows users to issue and trade assets, but these assets can be traded in exchange of the NTX coin. It is also not possible to do asset-to-asset exchange.

Users can generate assets based on NXT coin and these can bought, sold or traded on the open market. The generated assets can hold a value of their own like a crypto currency or loan marker, or can be representations of something physical that has value such as livestock, precious metals, or what ever NXT users have the creativity and capacity to imply to the asset.

The system also accepts deposits of tokens generated outside the NXT platform, such as Bitcoin, Litecoin and other crypto currencies.

The NXT coins can be used in areas such as private equities, public equities, bonds, derivatives, commodities, voting rights, vouchers, coupons, copyrights, patents, trademarks, and licenses such as music licences.

CounterParty DEX

CounterParty embeds data into regular Bitcoin transactions and allows the user to issue assets or tokens inside the Bitcoin blockchain. Users can trade assets for other assets with the protocol acting as a decentralized escrow service to hold the funds until the orders are matched. The asset is held in escrow and the other user manually pays in Bitcoin using the CounterParty wallet.

Pegged Asset Exchange (PAX)

Pegged Asset Exchange, which is being developed by SuperNet and Komodo, will let users exchange national currency assets with zero-knowledge proof level of privacy.

It will let users exchange existing fiat currencies, commodities, and stocks by pegging them to a cryptocurrency. With it, these assets can be traded against a range of cryptocurrencies listed on the InstantDEX exchange.

Waves Asset Exchange

Waves offers a decentralized exchange platform under development, which will allow users to trade assets, fiat tokens and cryptocurrencies. It combines both centralized services for order matching using a separate server but the transfer of funds is done on the blockchain.

OX

OX open protocol allows decentralized exchange on the Ethereum Blockchain for ERC20 compliant tokens. It uses off-chain order relay (which allows for fast settlement) and on-chain settlement

The off-chain order relay helps reduce gas costs and eliminating of blockchain bloat. Anyone can create a relayer that helps broadcast an order and collect fee each time they facilitate a trade.

Fully decentralized exchanges

Many of the fully functional decentralized assets that does not rely on proxy tokens, outside gateways , pegged assets or gateways to exchange cryptocurrencies are in the planning stages. This will remove more counterparty risks.

These platforms will allow for exchanging of cryptocurrencies through an atomic cross-chain protocol.

CryptoDerivatives.Market

CryptoDerivatives.Market is an on-block trustless, peer-to-peer Ethereum token exchange with low trading fees. It currently has 14 trading pairs.

In addition to being in control of your tokens, users can trade, deposit and withdraw tokens when they want. The trades are listed and executed directly from the user's wallet. It has a 0 apart from the Ethereum network transaction fees. It has a 14 second average Ethereum block time

See more on this link

Decentrex

Decentrex is a decentralized exchange that currently allows users to trade ERC20 token issued on top of the Ethereum blockchain without any limitation and without any account creation. It currently supports 450 tokens.

The open-source platform that also allows users to create smart tokens.

See more on this review.

Raiden

In addition to facilitating micropayment, P2P cash and retail payments, Raiden is an off-chain protocol that allows for instant token swaps from one person to another. Raiden is actually a payment channel network for Ethereum. It has been proposed as a way for machines to communicate (M2M communication) similar to solutions like IOTA and for API access.

BarterDEX

BarterDEX, which has an open-source technology developed by SuperNet, allows exchange of real coins in a P2P network with cross-chain atomic swaps.

Users are able to use the same utxo to place multiple orders for different coins. It currently supports multiple coins.

Bancor

Bancor uses an price discovery outside the decentralized exchange, which drives the price discovery on the blockchain. Arbitrageurs enter the market to buy the relatively undervalued asset while selling the relatively overvalued asset, while offsetting their positions with the external exchange.

The smart contract aims to solve problems of low liquidity and price inefficiencies as experienced in markets such as Poloniex, Kraken or Bittrex. Bancor with other ERC-20 tokens act as trading pairs, which can be bought, sold, converted. You can exchange it with all other tokens.

The open-source platform also allows users to create smart tokens in a variety of ways, for instance using messanger bots. See more on this review.

EasyDEX

EasyDEX platform will allow users to trade directly without the need for using proxy tokens. It is owned by Komodo and will, in addition to allowing users to exchange cryptocurrencies among themselves without entrusting their funds to a third party, allow for speed and liquidity.

OpenANX platform

OpenANX platform, which just sold 25,009,249.58 OAX tokens, wants to take advantage of payment channels such as Raiden, 0x, Swap, ERC20 to overcome challenges of centralized exchange markets. The system wants to hook current exchange platforms or Asset Gateways to the network and enforce a collateralized deposit system that helps users measure risks.

It will provide consumer protection through an off-chain, legally enforceable dispute resolution system . It will have fiat support, order book and Peer-to-Peer (“P2P) Over the Counter (“OTC”) order matching.

STEX

Currently, many traders operate on multiple cryptocurrency exchanges because some exchanges do not support their tokens. STEX exchange is hoping to solve this problem by introducing 10,000 exchangeable pairs in Q1 2018.

It will have additional features such as futures, options, hedge funds, leverage and margins, index funds and ETF.